Treasury’s Coal Investment Performance Analysis

A Report by Divest Oregon

December 2023

The UK’s windfarms generated more electricity than coal power plants for the first time in 2016. Photograph: Christopher Furlong/Getty Images

Report Summary

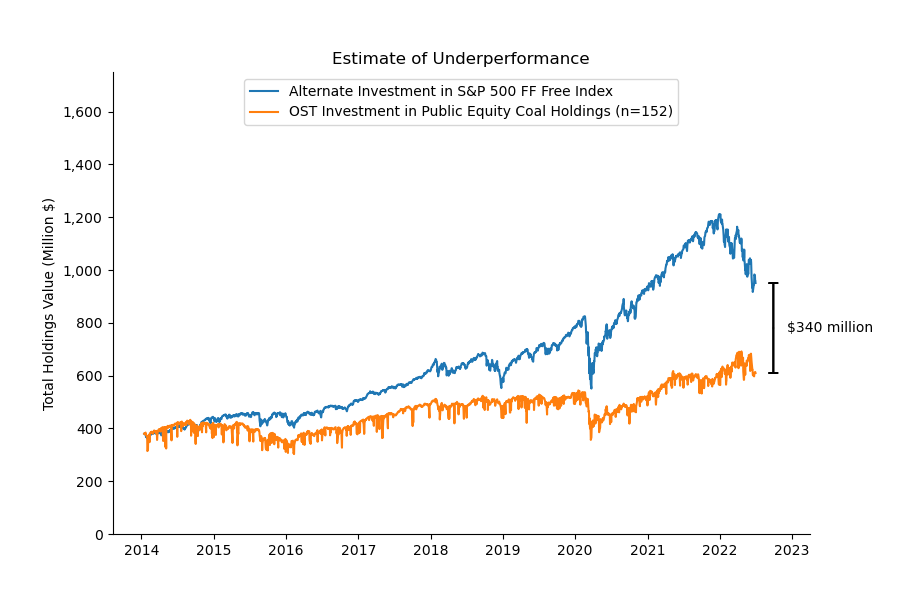

An increasing number of financial institutions, and public pension funds such as CalPERS, are exiting coal to avoid holding stranded assets. Yet, the Oregon State Treasury (OST) currently invests at least $610 million of PERS funds in public equity shares in coal companies. Divest Oregon set out to analyze how those coal stocks have performed over the last decade to determine if they have underperformed or performed well when compared to investing in the Standard and Poor’s Fossil Fuel Free Index.

If the PERS holdings in public equity coal companies had alternatively been invested in the S&P fossil fuel free index fund starting in January 15, 2014, they would have outperformed the coal investments by an estimated $340 million.