Addressing the Risk of Climate Change:

A Comparison of US Pension Funds' Net Zero Plans

Overview

With the publication of Oregon Treasurer Read’s Net Zero Plan (NZP), Oregon joins other large state pension funds addressing the inevitable impact of climate change on fund investments. Pension fund trustees have the “fiduciary duty” to manage their funds prudently and to make productive investments that preserve and protect fund assets and the viability of the pension system.

Climate change is increasingly changing investment risk. It impairs or destroys the value of some assets. Hurricanes, flooding, wildfires, and coastal loss collapse real estate and insurance markets. Drought degrades agricultural production. Meanwhile, climate change enhances the returns of other investments, such as solar panels, heat pumps, and other low-carbon technologies.

These fiduciaries in charge of investing for the future now face a whole new set of challenges: How will they protect beneficiaries from climate related losses? How will they invest in a more resilient future? What will the emerging economy look like as climate change dramatically alters all of our social and economic systems?

Treasurer Read’s NZP is only the latest large pension fund plan to take on climate change. Like thousands of investment funds across the world, other US large pension funds have established that addressing climate change is within their fiduciary duty. Moreover, they have concluded that NOT addressing climate change is a dereliction of that duty, putting beneficiaries at risk.

In this context, it will be critical to find the best climate risk mitigation approach by learning from others. Climate change is happening much faster than predicted and the world’s response is lagging. To see how Oregon’s approach compares with that of other pension funds, Divest Oregon has prepared a comparison of the large climate-aligned US pension funds’ net zero plans to identify which are planning the most aggressive, climate based science approaches to address investment climate impacts.

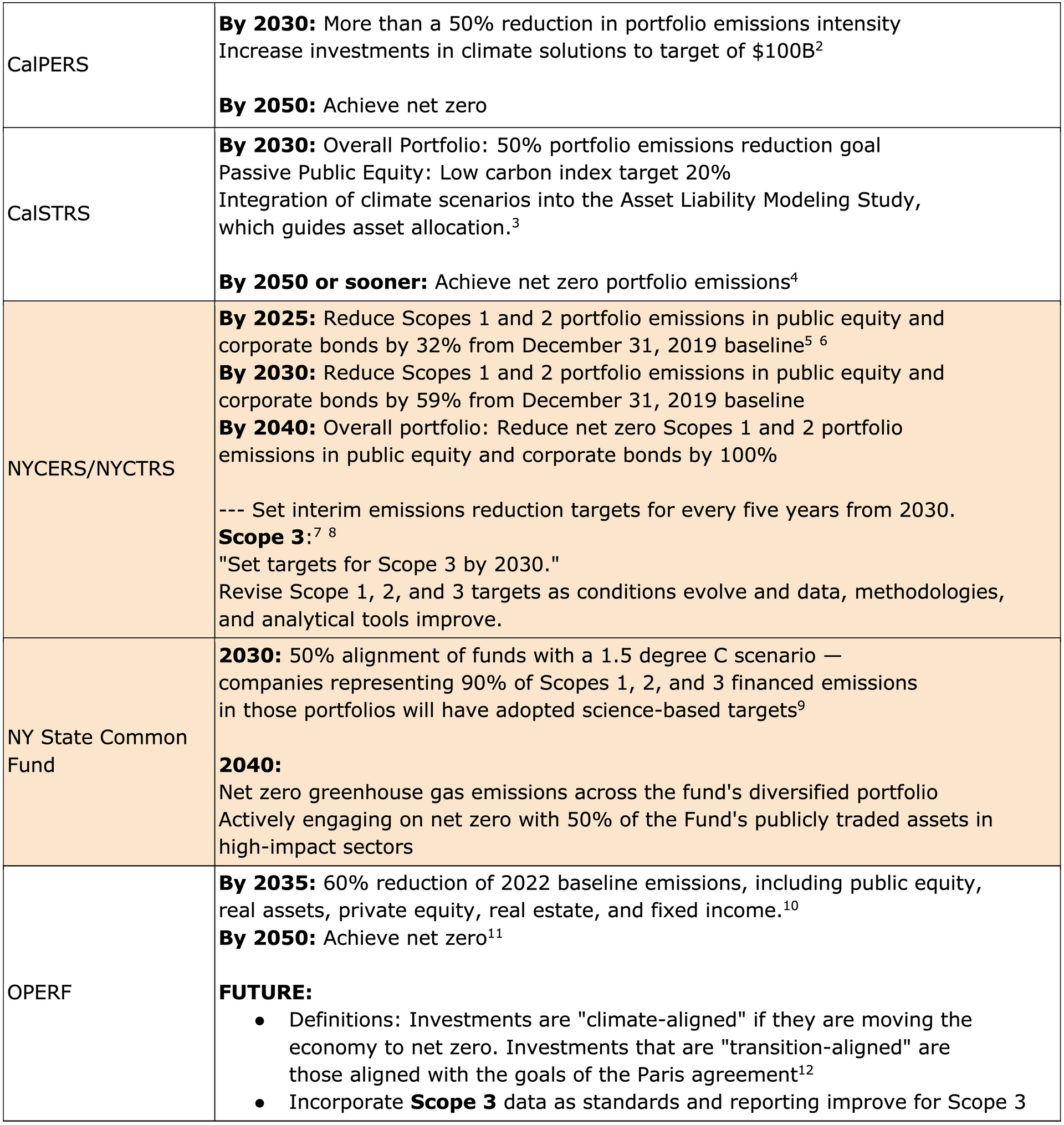

U.S. Pension Funds' Net-Zero Plan Comparison

Click here for these pension funds' assets and asset class allocations

*Click the cells to learn about implementation details for each plan

In comparing the US Public Pension Funds’ Net Zero Plans, these observations can be made:

Portfolio

Net Zero Target Dates

New York City and State have both set a

2040

Net Zero target date, having already completed significant fossil fuel divestments. With the world already having passed the Paris goal of holding temperature increases to 1.5 degree centigrade, funds with earlier climate risk mitigation targets are likely to protect funds more effectively than funds with later targets. Unfortunately, Oregon Public Employees Retirement Fund (OPERF) has set a less aggressive target Net Zero emissions date of 2050.

Just Transition

All but two of the plans reference the need to incorporate principles of a

just transition in their investment frameworks, particularly as part of investor engagements. But none offer time-bound demands or specific exclusion criteria for investments. Climate change increasingly and disproportionately impacts vulnerable communities and larger parts of the globe. Pension funds, including OPERF, urgently need to move from “principles” to “practice.” Oregon has the opportunity to be the leader in moving just transition principles into practice.

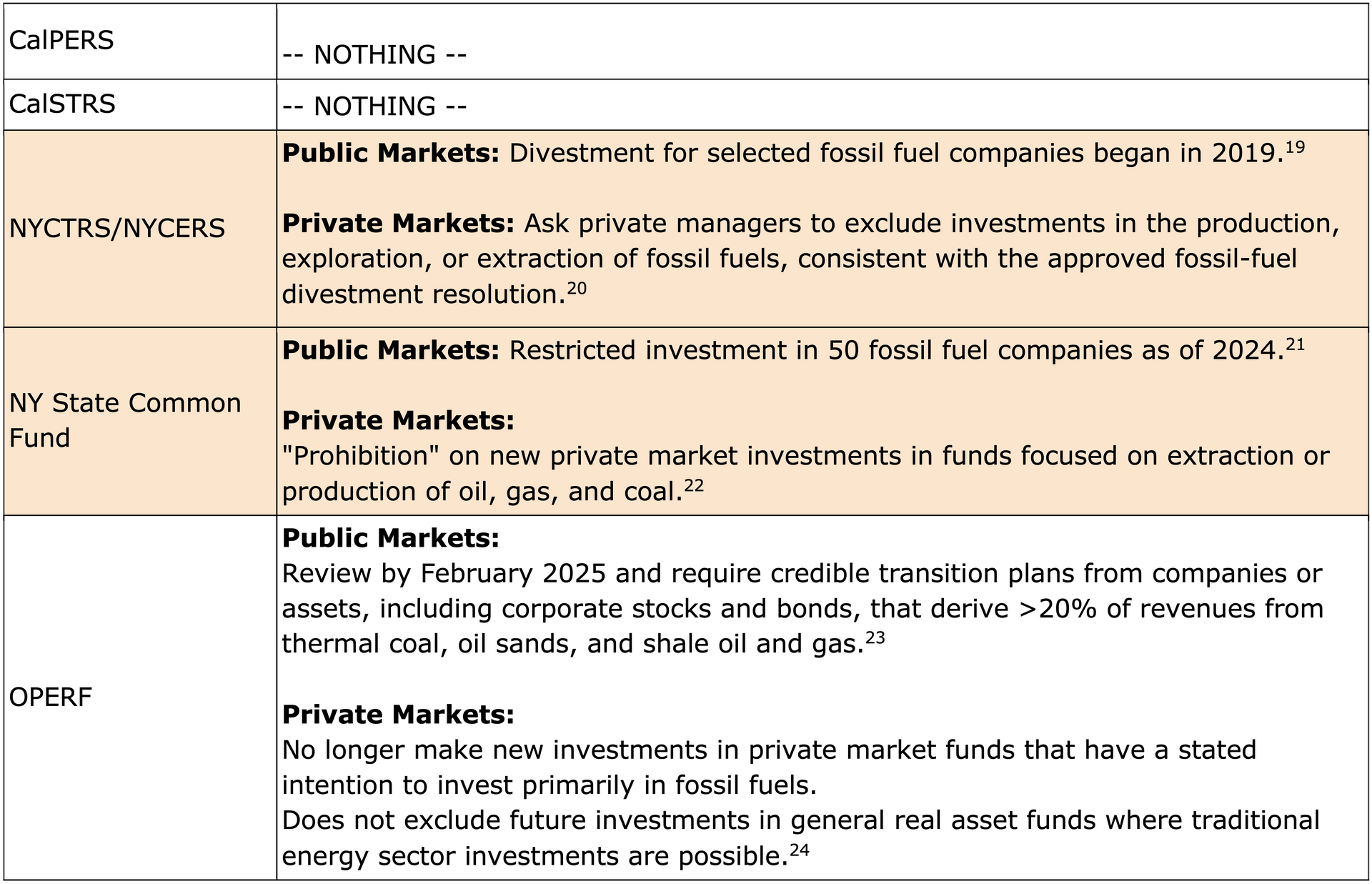

No New Investments in Fossil Fuels

Stopping new investments in fossil fuels is fundamental to any credible net zero plan. New York State and New York City pension funds both divested from selected publicly traded fossil fuel companies beginning in 2019. Both funds have also recently excluded new private market investments in the production, exploration, or extraction of fossil fuels. New York City funds have further proposed excluding private investments in midstream and downstream fossil fuel infrastructure. OPERF only requires public market investments in fossil fuel companies to have a “credible transition plan.” Private market funds are only restricted from investing “primarily” (undefined) in fossil fuels.

Oregon can improve its net zero plan by creating more robust investment criteria, including what qualifies as a "credible" transition plan and exactly how much fossil fuel investment is allowed in private market funds.

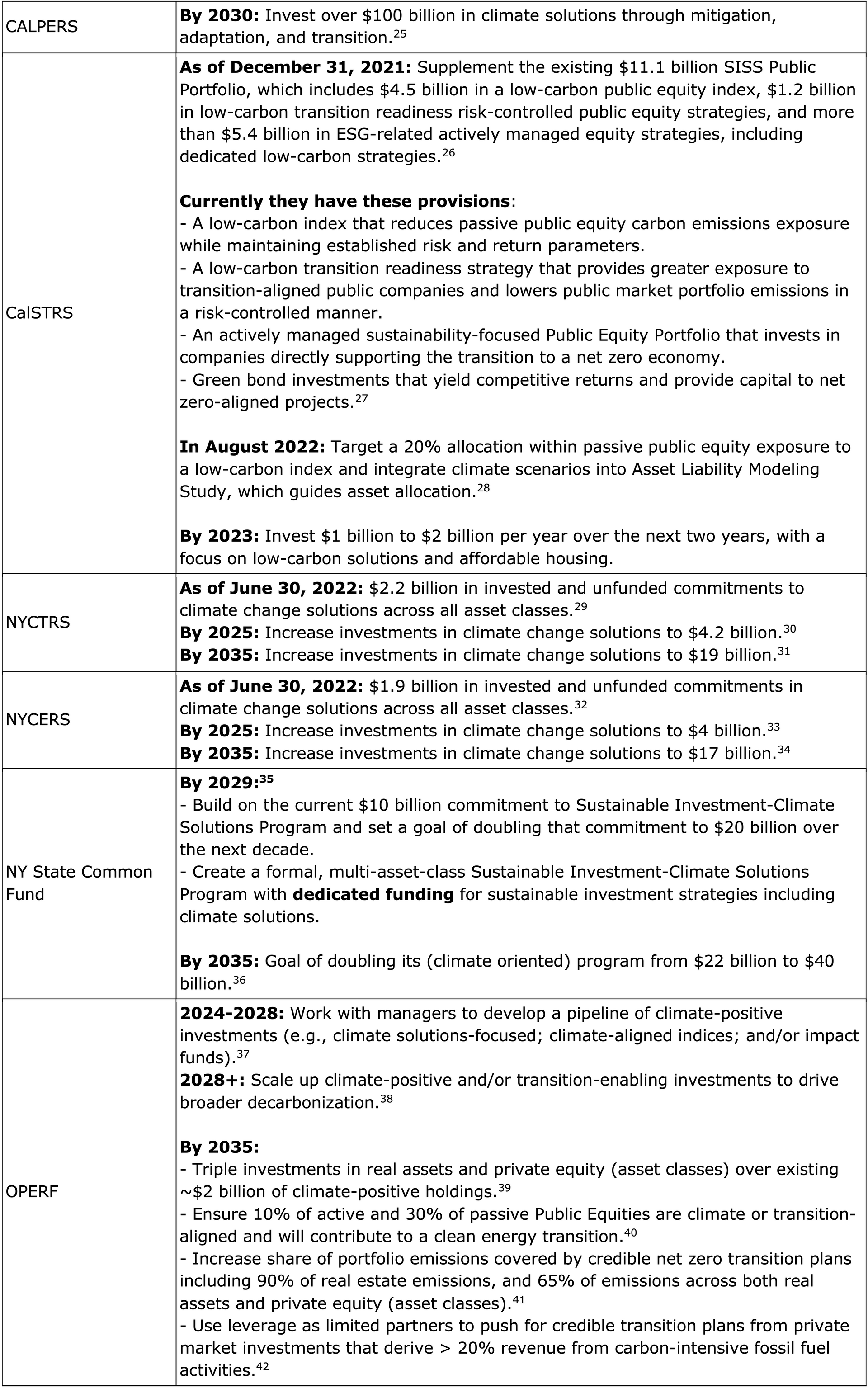

Climate Aligned Investments

Most of the plans have climate aligned investment targets. However, the definition of “climate-aligned investments” remains unclear in these plans, as does the rationale for the target dates and whether they will provide sufficient “climate proofing” to protect returns. Oregon’s Net Zero Plan calls for:

- increasing investment in “climate positive” holdings by 2035,

- increasing public investments that will contribute to a clean energy transition,

- tripling climate aligned investments in Real Assets and Private Equity asset classes, and

- ensuring that most emissions from real estate and private equity asset classes are covered by a credible net zero plan.

A significant problem for Oregon is that 60% of its portfolio investments are “private." Thus, there is no way for the public to know the exact nature of the “climate aligned” investments counted toward the targets.

While Oregon statute protects private investments from disclosing specific investments, aggregate reporting is possible and would significantly improve transparency.

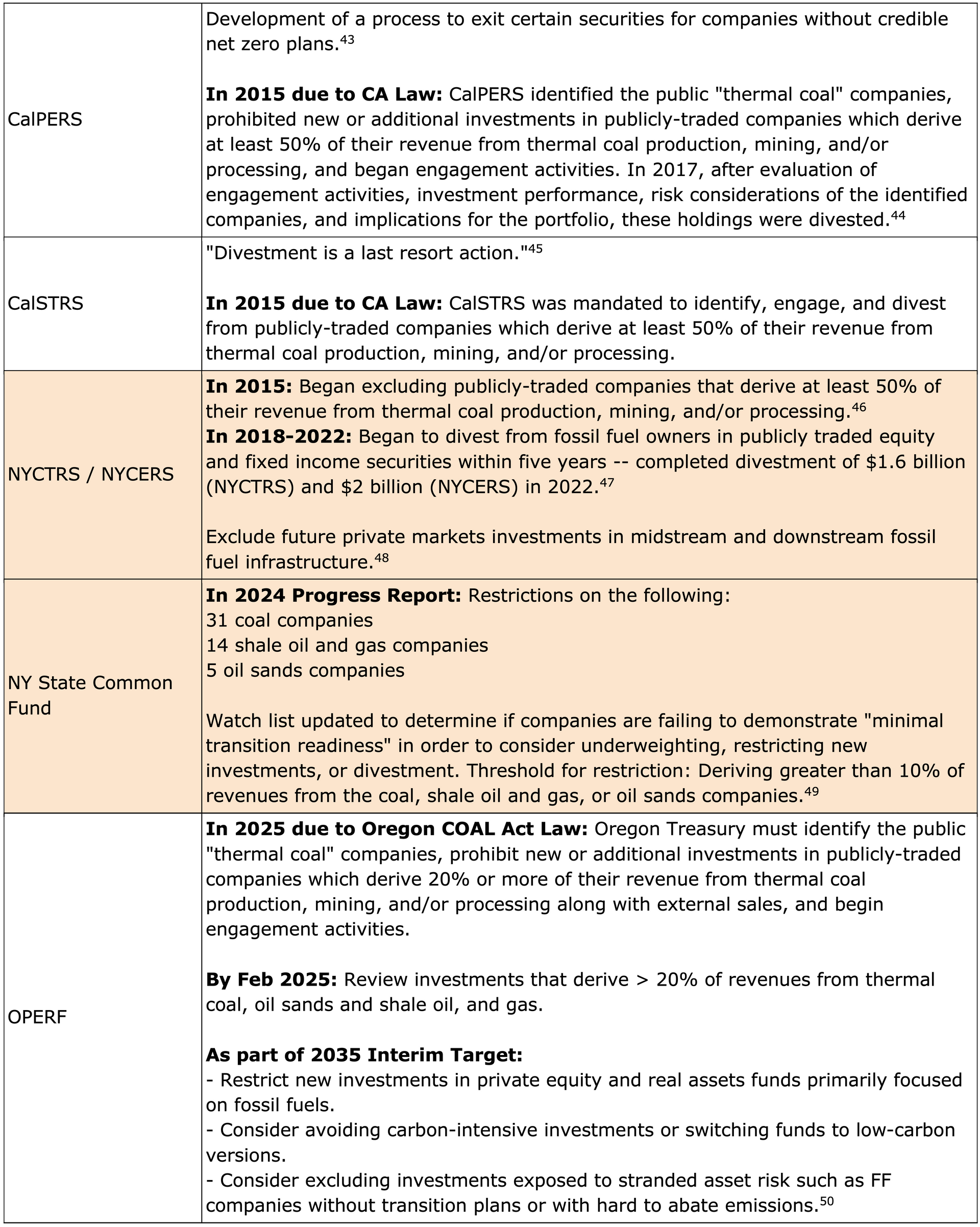

Fossil Fuel Divestment

The New York City Plans (NYCERS/NYCTRS) and New York State Common Fund (NYSCF) are clear leaders in

divestment from fossil fuel companies. NYCERS and NYCTRS have divested from $3.6 billion in publicly traded fossil fuel companies; New York State from 31 coal, 14 shale oil and gas, and 5 oil sands companies. Legislative action in California and Oregon have forced their funds to divest from selected “thermal coal” investments. Oregon is currently reviewing carbon-intensive publicly traded companies for their “transition readiness,” with no commitment to divest.

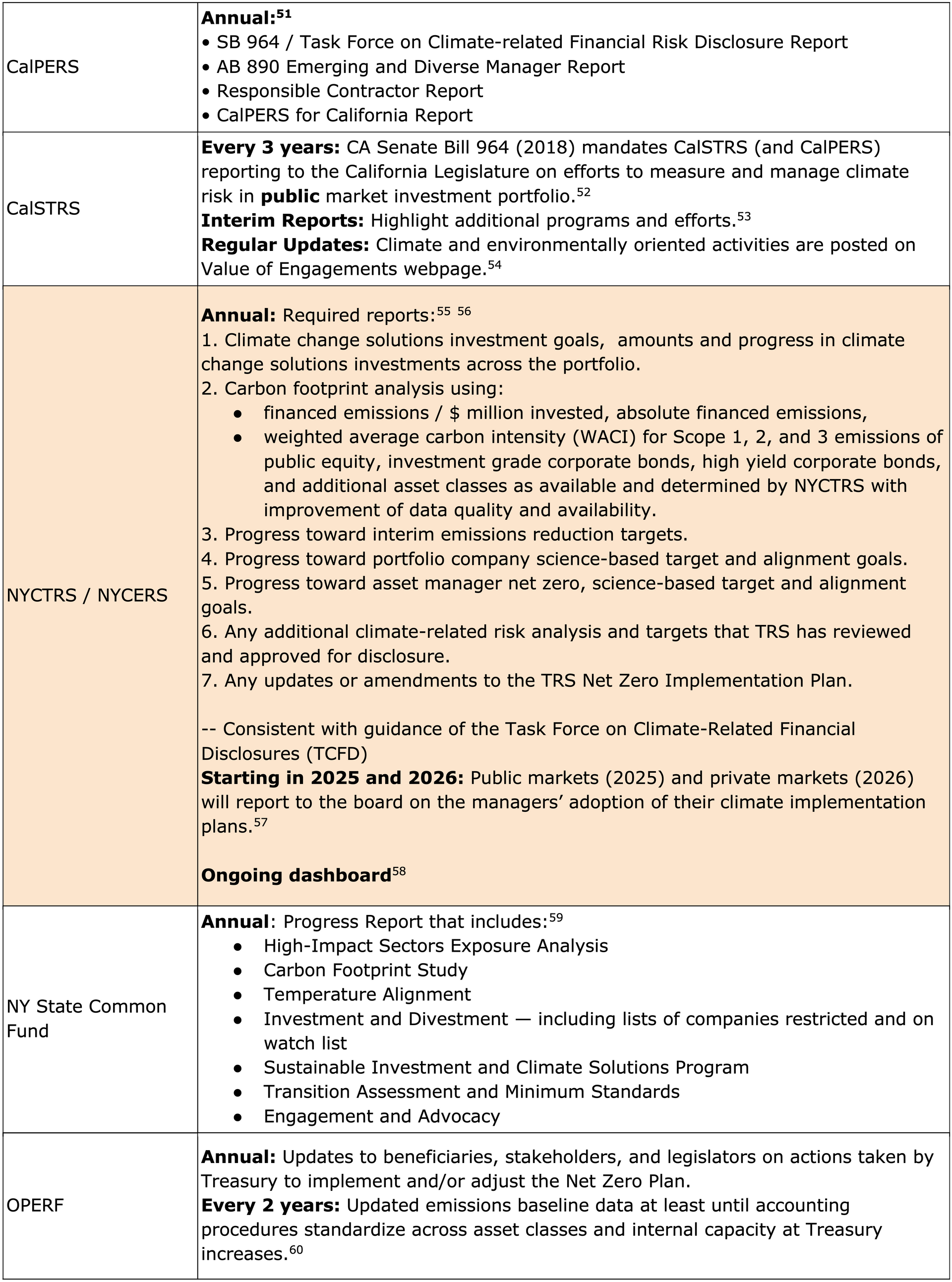

Reporting & Transparency

The New York City funds both have the most

comprehensive reporting and transparency with annual public reports, including dashboards that allow the public to monitor progress. Oregon has committed to annual public updates of actions taken to implement or adjust its Net Zero Plan, as well as biannual emissions data. Oregon's

2024 net zero plan annual report has been published.

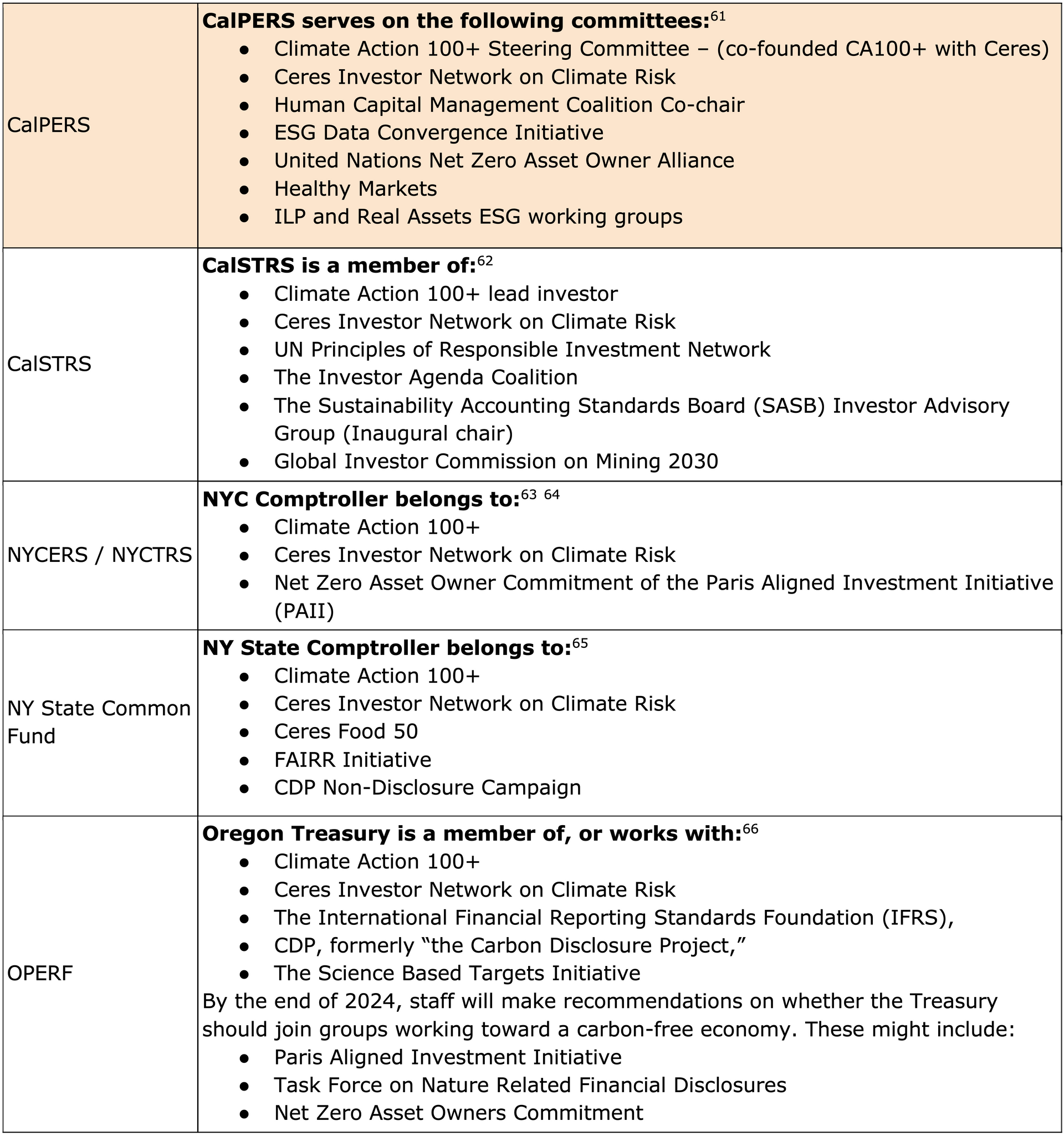

Climate Association Leader

CalPERS is a leader and member in climate-focused investor groups and coalitions. It serves as co-chair of the Human Capital Management Coalition and as a co-founder on the steering committee for Climate Action 100+ and has taken the pledge of the UN Net Zero Asset Ownership Alliance.

- Oregon PERS has minimal memberships in climate-focused investor shareholder groups, no leadership roles in those they do belong to, and a weak statement about future engagement with such groups.

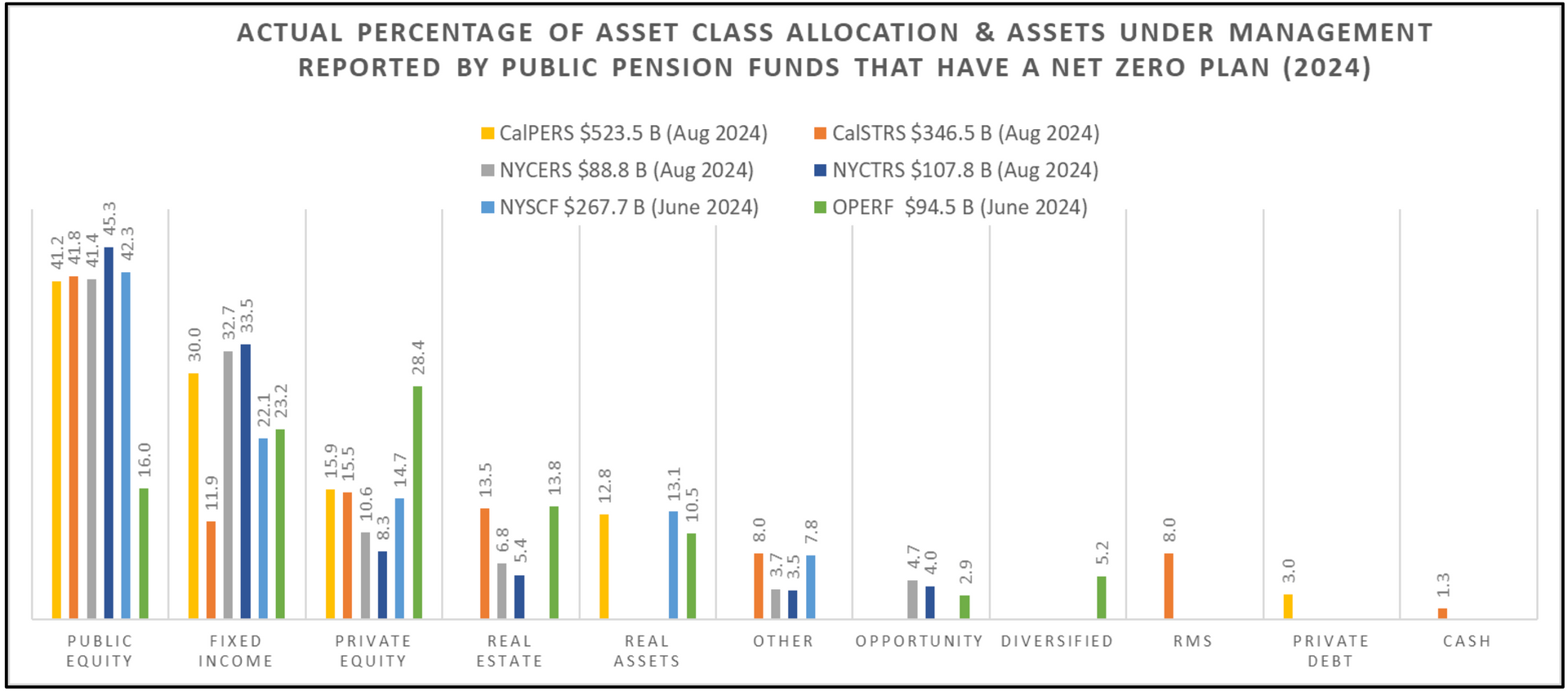

- OPERF also stands out as the pension fund with the lowest percentage of investments in public equity — companies in which shareholders and their proxies can vote to influence company governance and policy. Where other state funds (such as CalPERS) have 41-42% in public investments, reflecting the national pension plan average, OPERF has but 16%. (Around 60% of OPERF is in private investments, where the fund has no vote over investment policy.) “Shareholder engagement,” as a cornerstone of the Oregon Net Zero Plan, is likely to have little impact on industry behavior because they have proportionally so little investment in the public market holdings.

- Rebalancing the OPERF portfolio toward OIC investment policy targets is not only fiduciarily responsible, but will also increase Oregon's ability to assert meaningful investor engagement.

Portfolio Net Zero Target Dates

Summary: Deadlines for emissions reduction to portfolios set a standard for pension fund staff to work toward. Fiduciaries have set targets in New York City and State after starting a process to divest from the most polluting companies. New York City and New York State fiduciaries are evaluating Scopes 1, 2, and 3 in their holdings along with setting a 2040 deadline for net zero. CalPERS and CalSTRS are laggards because of the distance of their 2050 goal and failure to address Scope 3 emissions.

Integrating Principles of a Just Transition into Investment Framework

Summary: The transition to a low-carbon economy offers an immense opportunity to build a more just and equitable future. Integrating principles of a just transition is key to transitioning in a way that lifts up all communities and workers. The NYCERS and NYCTRS plans describe how they will integrate principles of a just transition in more detail than the other funds. The OPERF and CalPERS plans mention a just transition only briefly. However, CalPERS’ “Labor Principles” and “Governance and Sustainability Practices” include considerations such as human rights, Indigenous peoples’ rights, and labor practices. For all of these plans, the integration of principles of a just transition falls within their engagement strategy only. While they may include principles of a just transition in their assessment of companies, none of the plans offer time-bound demands or escalation strategies such as sanctions or divestment. Nor do they mention updating proxy voting guidelines. For that reason, all of the plans are insufficient to truly convince companies to align with just transition principles.

No New Investments in Fossil Fuels

Summary: New investments in fossil fuels only add to the current emissions and climate crisis. NY State is a leader with its recent (2024) statement prohibiting new private market investments in funds focused on extraction or production of oil, gas, and coal. CalSTRS and CalPERS have made no statements regarding new investments in fossil fuels.

Climate Aligned Investments

Summary: As pension funds move away from emissions-producing fossil fuel investments, they are able to channel those funds into climate-aligned investments. All of these funds have committed to or are moving toward increased climate-aligned investments; the definition of those investments and the pace of the new investments are both questionable. Thus, no leader has been identified.

Fossil Fuel Divestment or Exclusions

Summary: Excluding or divesting from companies or funds that are predominantly producing Scope 1, 2, and 3 emissions is good for the climate, as well as the bottom line in the long term. NYCERS/NYCTRS and New York State started on this work of exclusions early and have begun restrictions. New York State Common Fund has the most stringent threshold of no greater than 10% of revenue from coal, shale oil and gas, and oil sands. NYCERS/NYCTRS announced in 2024 that they would be excluding future private markets investments in midstream and downstream fossil fuel infrastructure.

Transparency & Reporting

Summary:

Regular analysis and reporting of the reduced emissions in the portfolio are key to allowing the public and pension boards to assess progress. NYCERS and NYCTRS have a list of reports that are provided annually. In addition, they have a dashboard where the concerned public citizen can see their progress. CalSTRS has only legislatively mandated reporting every 3 years with ad hoc "regular" interim reports.

Membership in Climate-focused Investor Groups & Coalitions

Summary:

Membership in climate-focused investor groups can encourage pension plans to set standards, pressure companies to change, advocate for policy changes, and ultimately move markets. Membership can also be passive, and thus considered greenwashing. The ranking of CalPERS as best in class is based on their serving in leadership roles in various groups, such as co-chair of the Human Capital Management Coalition and on the steering committee for Climate Action 100+. They also have taken the pledge of the UN Net Zero Asset Ownership Alliance. CalSTRS is a close second as a lead investor at Climate Action 100+. OPERF was ranked worst in class for minimal memberships, no evidence of leadership in any of the groups, and a weak statement about future engagement in such groups.

Assets Under Management (AUM) and Asset Class Allocations

References

- CalPERS board members voice concerns about investing in Exxon after testimony from beneficiaries (Daily Kos, 3/21/2024)

- CalPERS’ Sustainable Investments 2030 Strategy p. 3, 4, 9

- Addressing Climate-Related Financial Risk Report p. 4

- Addressing Climate-Related Financial Risk Report p. 4

- NYCERS Net Zero Implementation Plan p. 8

- TRS Net Zero Implementation Plan p. 8

- NYCERS Net Zero Implementation Plan p. 8

- TRS Net Zero Implementation Plan p. 8

- New York State Common Retirement Fund Climate Action Plan Progress Report p. 1

- A Pathway to Net Zero p. 6, 21

- A Pathway to Net Zero p. 6, 21

- A Pathway to Net Zero p. 40

- CalPERS' Sustainable Investments 2030 Strategy p. 17

- CalPERS' Governance and Sustainability Standards p. 26 and 36. *Note: this document is not specific to the net zero plan

- NYCERS Net Zero Implementation Plan p. 6, 10, 28-29

- TRS Net Zero Implementation Plan p. 6, 10, 29-30

- NYCERS Net Zero Implementation Plan p. 29

- A Pathway to Net Zero p. 22, 76

- Comptroller Stringer and Trustees Announce Successful $3 Billion Divestment from Fossil Fuels

- NYC Comptroller Lander Proposes Excluding Future Private Markets Investments in Midstream and Downstream Fossil Fuel

- Infrastructure by the New York City Retirement Systems

- New York State Common Retirement Fund Climate Action Plan Progress Report p. 5-11

- A Pathway to Net Zero p. 25

- A Pathway to Net Zero p. 56

- CalPERS’ Sustainable Investments 2030 Strategy p. 3

- Green Initiative Task Force p. 9

- Addressing Climate-Related Financial Risk Report p. 14

- Addressing Climate-Related Financial Risk Report p. 4

- TRS Net Zero Implementation Plan p. 32

- TRS Net Zero Implementation Plan p. 10

- TRS Net Zero Implementation Plan p. 7

- NYCERS Net Zero Implementation Plan p. 31

- NYCERS Net Zero Implementation Plan p. 6

- NYCERS Net Zero Implementation Plan p. 11

- NY State Common Retirement Fund Climate Action Plan 2019 p. 9

- NYS Pension Fund Commits $2 Billion to Climate Transition Index

- A Pathway to Net Zero p. 26

- A Pathway to Net Zero p. 44

- A Pathway to Net Zero p. 21

- A Pathway to Net Zero p. 21

- A Pathway to Net Zero p. 22

- A Pathway to Net Zero p. 26

- CalPERS’ Sustainable Investments 2030 Strategy p. 10

- CalPERS’ Sustainable Investments 2030 Strategy p. 15, 17

- CalSTRS' perspective on fossil fuel divestment

- NYCERS Net Zero Implementation Plan p. 35

- NYCERS Net Zero Implementation Plan p. 34

- NYC Comptroller Lander Proposes Excluding Future Private Markets Investments in Midstream and Downstream Fossil Fuel Infrastructure by the New York City Retirement Systems

- New York State Common Retirement Fund Climate Action Plan Progress Report p. 5-11

- A Pathway to Net Zero p. 26

- CalPERS’ Sustainable Investments 2030 Strategy p. 19

- CA Senate Bill 964 (2018)

- Green Initiative Task Force

- Engagements in Action

- TRS Net Zero Implementation Plan p. 24

- NYCERS Net Zero Implementation Plan p. 24

- TRS Net Zero Implementation Plan p. 7

- NYC Climate Dashboard

- Leading the Way on Climate Investment

- A Pathway to Net Zero p. 82

- CalPERS’ Sustainable Investments 2030 Strategy p. 19

- Engagements in Action

- NYCERS Net Zero Implementation Plan

- TRS Net Zero Implementation Plan

- New York State Common Retirement Fund Climate Action Plan Progress Report

- A Pathway to Net Zero p. 75-76