Oregon Treasury's "Climate Risk Assessment" Report (Oct 2021) & “Climate Risk Scenario Modelling” Report (Feb 2022)

Conducted by Ortec Finance and paid for by Oregon Treasury

These reports were obtained through a lengthy Public Records Request process starting in January 2022. They have not been published anywhere else. They are not on the Treasury website.

Note: The less redacted December 2022 Climate Risk Assessment report was prepared in September, but held until after the Treasurer's press release in November 2022.

Climate Risk Assessment Summary

Holding onto PERS public equity fossil fuel investments is a big financial loser.

In February 2022, Treasury's climate consultant, Ortec, provided its “deep dive” scenario modelling analysis report about divesting Oregon's Public Employee Retirement System Funds (OPERF) from fossil fuels....

A year later, Treasury finally revealed that report after pressure from Divest Oregon.

TOP LEVEL FINDING: Holding onto PERS public equity fossil fuel investments is a big financial loser.

The baseline loss over the next 5 years for not divesting OPERF fossil fuel holdings would be 14.5% in a disorderly transition (current state of affairs).

For private equity, the Climate Risk Assessment report says, "More so than for listed equity, the failed transition (FT) scenario highlights the physical risk exposures of the PE portfolio." Because of the longterm contracts held for private equity funds, "The illiquidity of this asset class suggest that climate risk should be considered as part of deal due diligence, since exiting positions can take significant time."

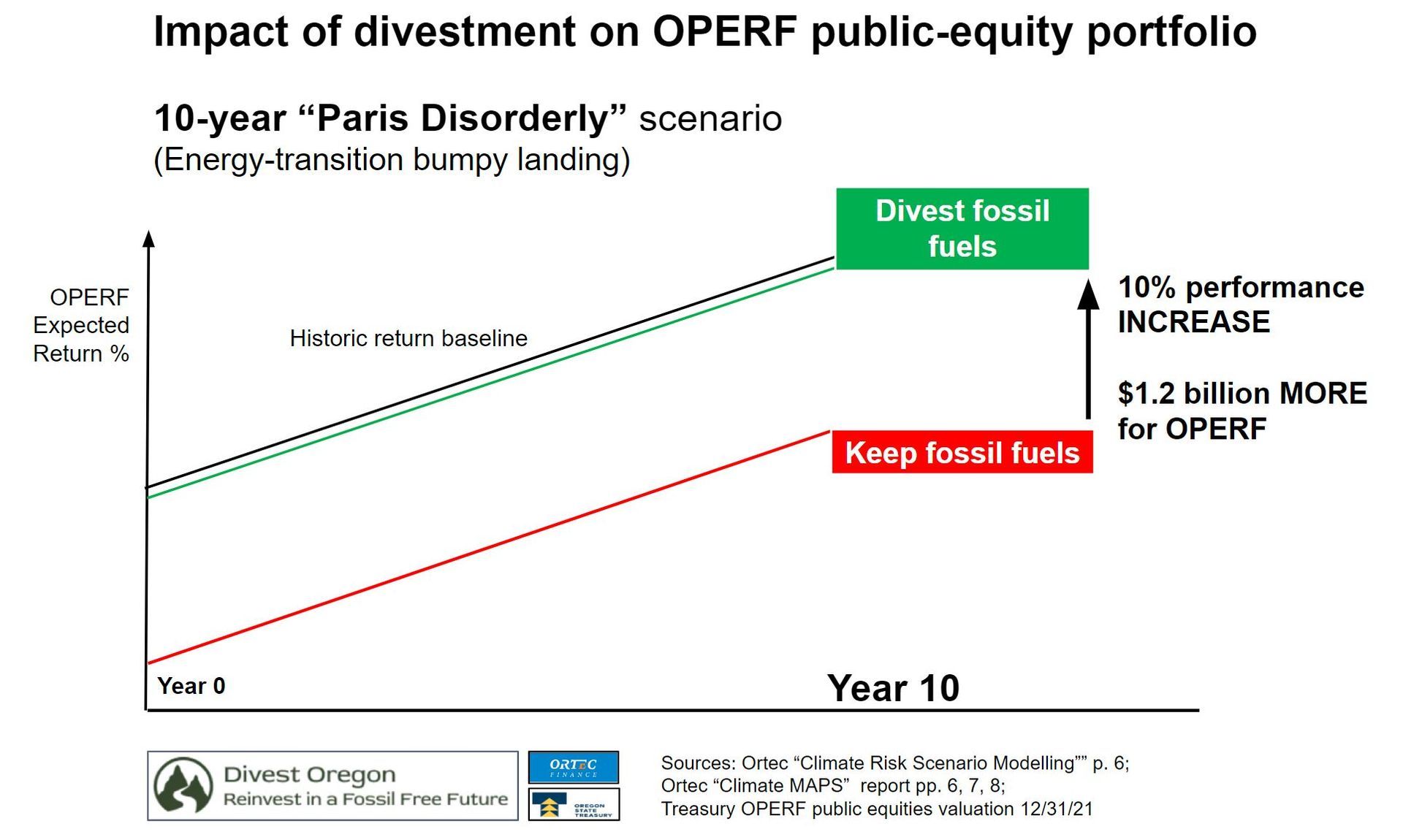

The Treasury's report, hidden for a year, called "Climate Risk Modelling Scenario" concluded that fossil fuel divestment would increase OPERF returns

Treasury asked international consultant Ortec Finance:

- “What if OPERF divested from its liquid-market fossil fuel investments? What is the interplay between risk and return from that?”

Ortec's answers:

- Divestment from fossil fuel investments increases OPERF public equity portfolio value by $1.2 billion over 10 years in scenario titled "Paris Disorderly"

- Gains are even greater if fossil companies reject becoming part of clean energy transition

- Gains from divesting other asset classes seem likely

- Treasury can act to protect OPERF from 20% devaluation by investing to encourage a clean energy transition

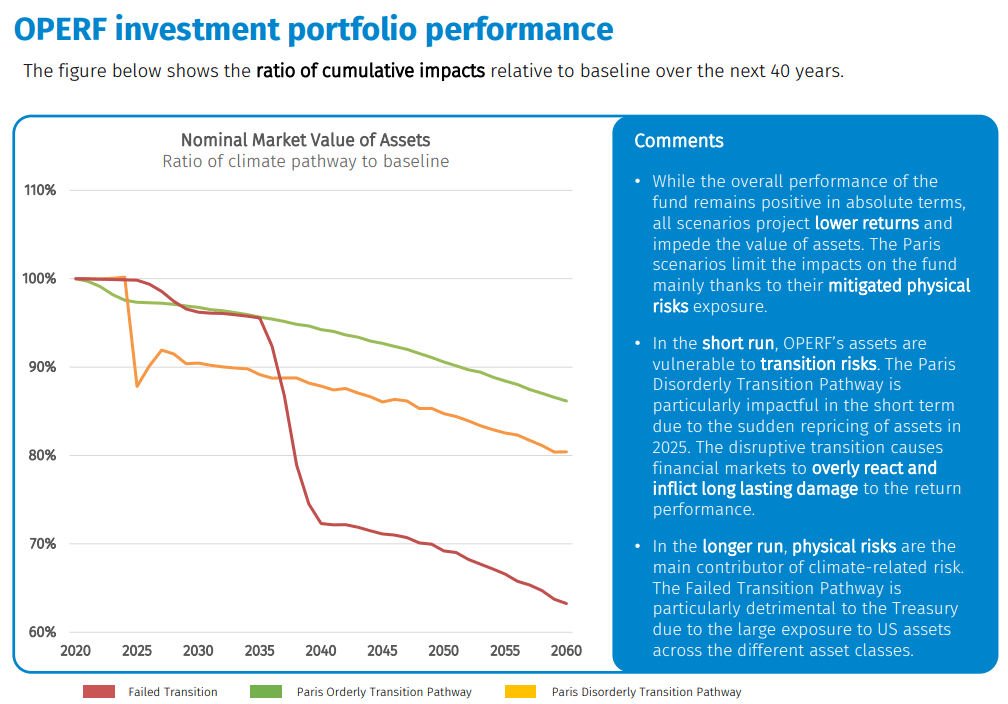

The Climate Risk Assessment report warns of reduced investment returns to the Public Employee Retirement System due to climate risks in 3 likely scenarios of transition to a low carbon economy.

The three models are based on potential future climate policies, interventions, and consequences of the world failing to mitigate climate change.

The following figure is from the Climate Risk Assessment report.

01 Paris Orderly Transition

The transition to a low carbon economy is assumed to occur as smoothly as possible; nations fully meet their commitments to the Paris Accords.

02 Paris Disorderly Transition

The transition has disruptive effects on financial markets. Prices of fossil fuels fall (“repricing”).

03 Failed Transition

Economies follow the business-as-usual track without additional new policy measures. Actions are too little, too late, and result in a hot house world scenario.

The Climate Risk Assessment Report predicts "lower return expectations across all assets due to negative climate impacts over time," but some asset classes are less resilient than others.

The Climate Risk Assessment report cites private equities and properties as highly sensitive to price reductions. “The most notable exposure stems from US Oil & Gas that represents 30% of the [real assets] portfolio. This sector is expected to suffer significantly during the transition.”

THE REPORT IS A CLEAR CALL TO DIVEST FROM FOSSIL FUELS, AND TO DO SO QUICKLY.

Climate related risks will have a costly impact on the OPERF portfolio if the Oregon Treasury continues to invest as usual.

Recommendations from the

Climate Risk Assessment

Manage the climate risks in the portfolio. “We recommend that using this analysis, you could work with your fund managers and advisors further integrating climate into your investment process.”

- Reduce exposure to US securities

- Consider positioning the portfolio toward a low-carbon (net zero) transition

- Prioritize transition risk management focused on exposure to the energy and utilities sectors…and private equity

Prioritize climate change engagement and climate conscious governance of real assets.

“Careful, climate-risk informed choice of longer term, illiquid assets" or in other words - private investments.

Evolve processes to embed climate change analysis at every level of risk analysis and decision-making along the investment process.

Regularly engage with stakeholders and communicate OPERF’s vision and strategy on climate and ESG issues.

Ensure OPERF’s public climate commitments continue to be underpinned by further climate change training and capacity building for internal teams and external facing staff.

Check out the redacted Climate Risk Assessment Reports for yourself...

and join us in urging the Oregon Treasury to take action.