RISKY BUSINESS: OREGON TREASURY'S FOSSIL FUEL PROBLEM

Download the Q2 2022 raw data obtained from the Oregon State Treasury by Divest Oregon via public records request.

Download the Q2 2021 raw data obtained from the Oregon State Treasury by Divest Oregon via public records request.

Risky Business Report Summary

Updated May 2023

From heat domes to droughts, from coastal dead zones offshore to vanishing snowmelt and groundwater, climate change has already arrived in Oregon with widespread and devastating effect.

Oregonians are worried. A series of short stories compiled by the Oregon League of Conservation Voters depicts the new reality of scorched trees, a snowless Mount Hood, and the disappearance of insects, birds and animals from the state's famous landscapes.

Those Oregonians navigating rising houselessness, the state’s legacy of white dominance, and rural poverty are bearing the brunt of climate change with the most vulnerability and the fewest resources to cope with this new reality.

Burning oil, gas, and coal is the

main cause of climate change.

When they are burned, these non-renewable fossil fuels release greenhouse gasses like carbon dioxide and methane into the air, causing the planet to heat up and creating unprecedented and increasingly dangerous weather events. Fossil fuel companies — which drill or mine for non-renewable energy sources, refine them for use as fuel, or burn them for electricity — have contributed more than any other sector to global climate chaos.

Now, thanks to major shifts in cost and technology, the world is moving away from fossil fuels towards clean energy at an accelerated pace. There are now more than 1,500 institutions publicly committed to at least some form of fossil fuel divestment, representing an enormous $40 trillion of assets under management. Investors left holding stock in fossil fuel companies will find their holdings becoming riskier, or even worthless, over time.

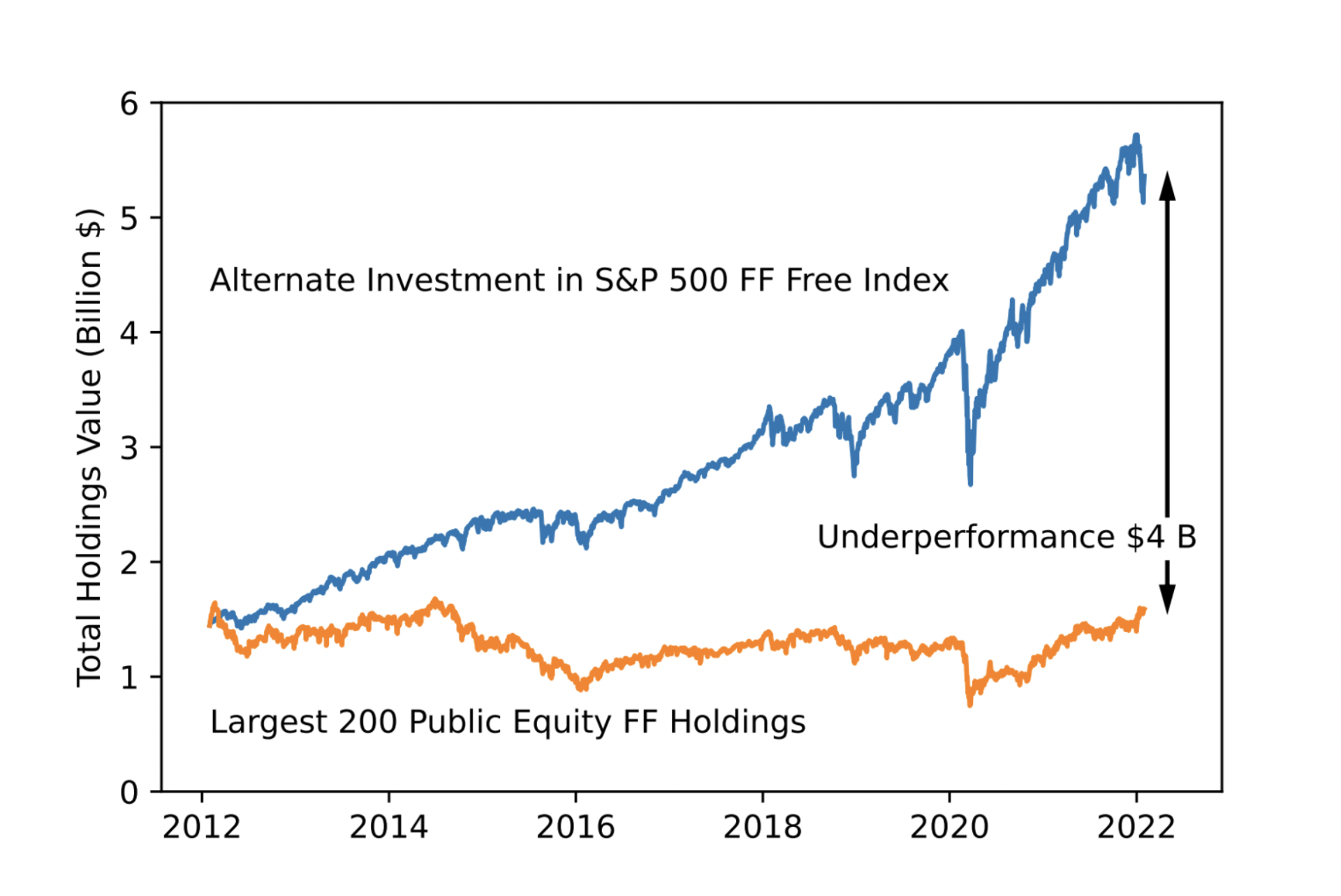

In general, funds with significant fossil fuel investments have provided lower returns over the past decade than funds without. An evaluation of the Oregon State Treasury's (OST) fossil fuel investments over the past decade conservatively estimates that they underperformed compared with a fossil fuel free alternative by $4-10 billion. In other words, Oregonians could have seen an additional $4-10 billion of revenue had the Treasury not invested public funds in fossil fuels.

Despite the risks of future long-term underperformance, the OST continues to make NEW investments in the volatile fossil fuel industry and refuses to commit to a phased divestment plan.

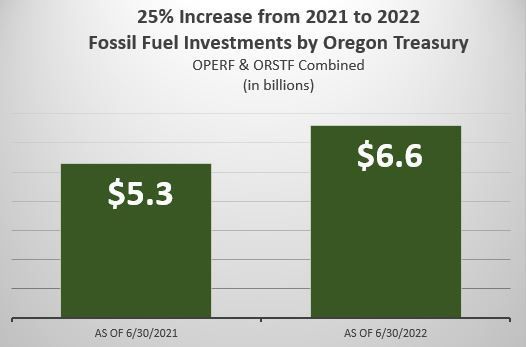

Rather than championing the necessary and massive shift in the energy sector, the Oregon State Treasury has INCREASED its fossil fuel holdings from $5.3 billion in 2021 to at least $6.6 billion in 2022 in the Oregon Public Retirement Fund (OPERF) and the Oregon Short Term Fund (ORSTF).

The full extent of the increase is unknown because the total amount invested in fossil fuels in private investments is unknown. These private investments are kept from public disclosure by state law, but it is well known that many private investment funds are heavily invested in fossil fuels.

This 25% increase in fossil fuel investments is a result of both NEW fossil fuel acquisitions and larger holdings of previous fossil fuel companies. Throughout 2022 and early 2023, the OST entered into NEW private investment contracts that are known to be heavily involved in fossil fuel extraction and distribution.

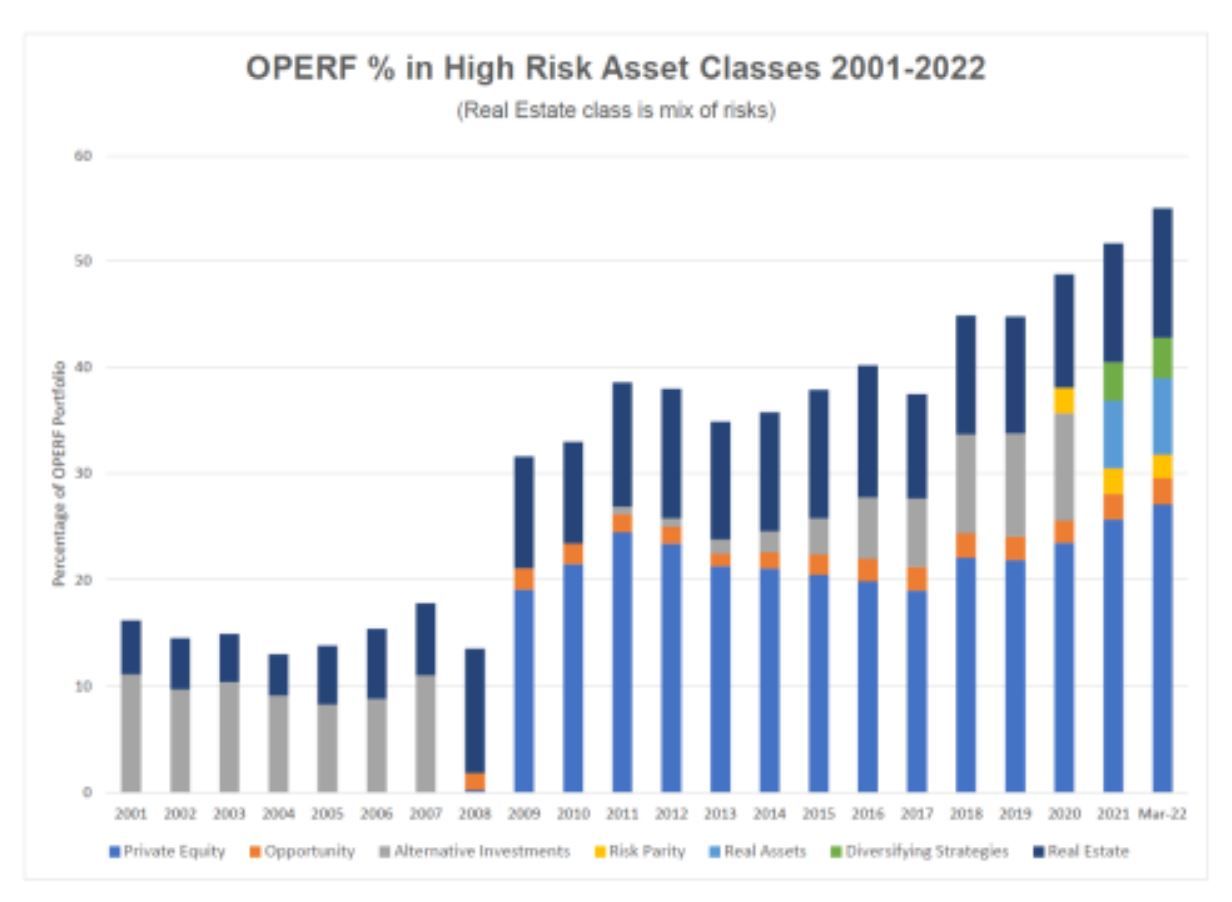

Research since the Risky Business report was published in April 2022 has revealed that over 50% of PERS is in private investments - which are highly risky. These investments are shielded from disclosure by state law and by contract. They are listed in many different asset classes in addition to the Private Equity asset class as shown in this figure - Opportunity, Alternatives, Risk Parity, Real Assets, Diversifying Strategies and Real Estate.

The amount of private investment holdings in OPERF is an extreme outlier among comparable US public pension funds. See

Oregon Treasury's Private Investment Transparency Problem

report for an in-depth analysis.

The writing is on the wall. It is past time for the Oregon State Treasury to follow the emerging norm of fossil fuel divestment,already initiated by smaller bodies across the state, and to reinvest in Oregon’s fossil-free future.

This report details the investments in fossil fuels made by the Oregon State Treasury that are known to the public, and outlines how continued support of the fossil fuel industry by the state exposes Oregonians to climate and health risks, economic costs, and financial losses.

Risky Business Report (2022)

Highlights

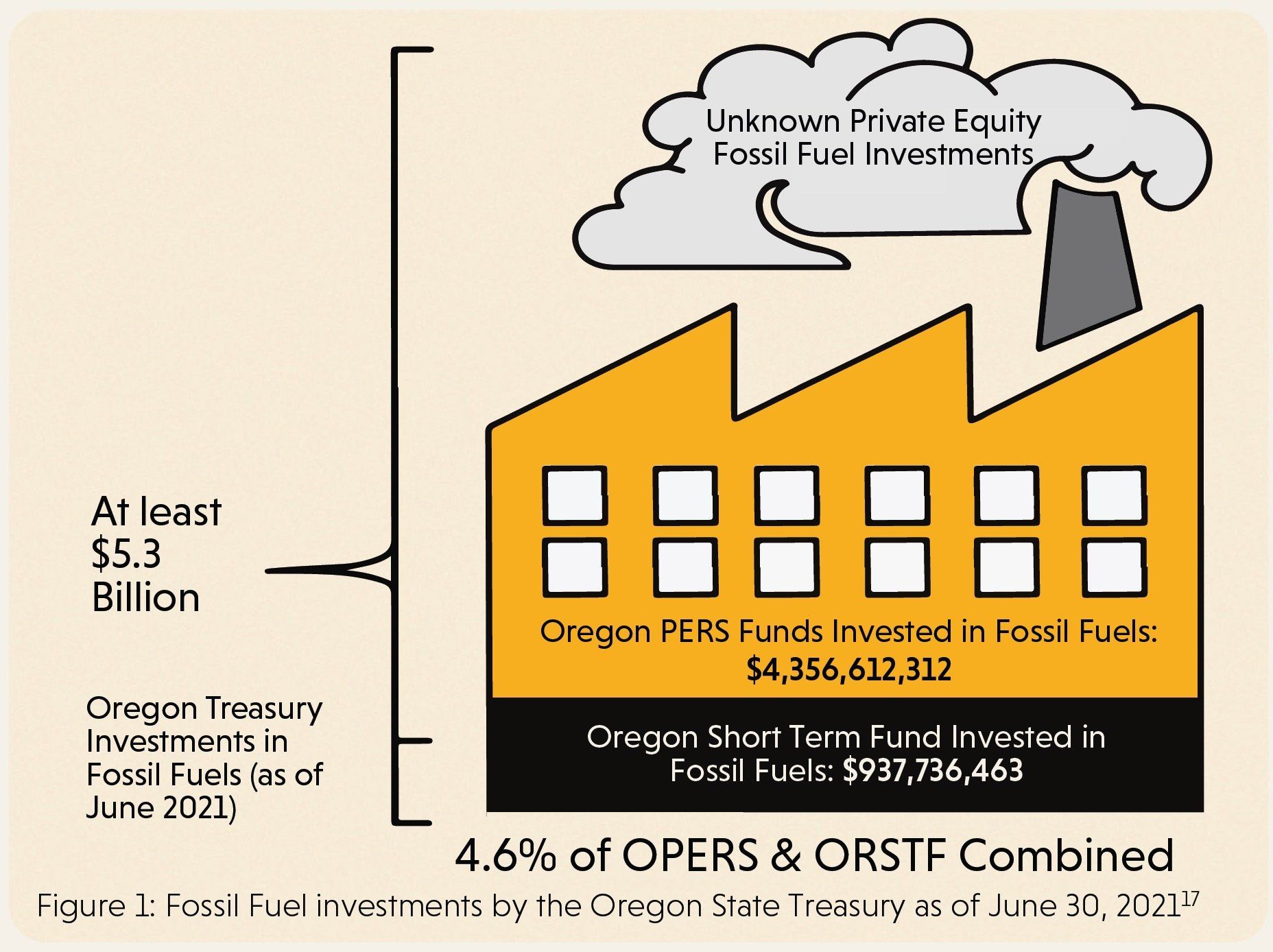

As of June 2021, the Oregon State Treasury (OST) had at least $5.3 billion invested in fossil fuel companies (see Figure 1). Fossil fuel companies drill or mine for non-renewable energy sources (such as oil, gas, and coal), refine them for use as fuel, or burn them for electricity. $5.3 billion is $500 million more than the federal budget for energy efficiency and renewable energy in 2022!

The full scope of OST’s fossil fuel exposure is unclear. Noticeably absent in the response to the public records request is specific holdings information on OST’s private equity holdings.

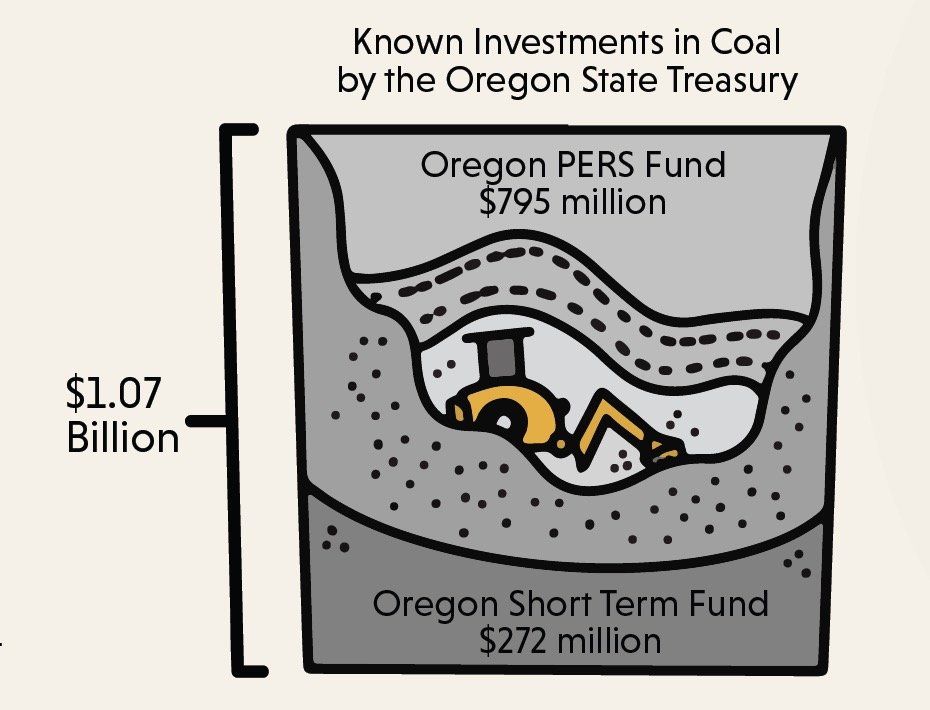

"The Oregon State Treasury had at least $1.07 billion invested in the coal industry in 2021."

It seems incongruous that we would still be investing in coal when Oregon prides itself on closing its last coal-fired power plant in 2020 because it was the largest single source of greenhouse gas emissions in Oregon. If it’s too dirty for Oregonians, why is it okay for anyone else?

"Over the past decade, fossil fuel public equities have underperformed compared with whole-market indices."

Looking back at Oregon State Treasury's investments over the same past decade, we estimate that OST's fossil fuel holdings underperformed in comparison to fossil fuel free indices by at least $4 billion. This $4 billion estimate is a low estimate of the underperformance because the analysis includes only some of the known fossil fuel holdings. It may be underperformance of $10 billion.

Add your paragraph title here

The report was produced in partnership with Stand.earth, 350.org, the Private Equity Stakeholder Project, Environment Oregon, Ecumenical Ministries of Oregon, and Oregon Physicians for Social Responsibility.

Watch the April 2022 report launch event

with special guest speakers Bill McKibben, from Th!rd Act, and Amanda Mendoza, from Private Equity Shareholders Project.