The Oregon Pioneer atop the Oregon State Capitol in wildfire season

2025 Climate Risk Review:

No Place to Hide

May 2025

Published by Divest Oregon

Report Context

Public employees around the country depend on their public pension funds for their retirement. In Oregon, 400,000 people (10% of the state’s population) and their families depend on the Oregon Public Employees Retirement Fund (OPERF).

How does climate change affect the viability of the investments in the fund? How can the managers of OPERF, and other pension funds, protect the financial well-being of current retirees as well as that of younger generations?

To answer these questions, the

2025 Climate Risk Review explores 200 pieces of crucial climate, economic, and investment research by academics, professionals and governments on the risks of climate change on investments.

<< need to add in something about why it's called "no place to hide" here >>

Our situation is

perilous.

Climate change is a risk like no other. The fires, the floods, and the hurricanes, all tell the story: climate change is undeniable and threatens global economies.

The world is hurtling toward and past 3°C (5.4ºF) average global warming by the end of the century. The hotter it gets, the worse the physical damage, and the worse the economic damage.

“The major point (of the report) is strong, valid and well presented — abating climate change produces economic and investment benefits far outweighing costs. The stewards of pension fund assets should exercise all the pressure they can to avoid the severest climate outcomes."

RICCARDO REBONATO,

Professor of Finance, EDHEC Business School; Scientific Director, EDHEC Risk Climate Institute; author, “How to Think About Climate Change”

Climate risk is financial risk.

Climate change and the economic damage it wreaks is the mother of all risks to pension funds. Many economists identify substantial financial risks from climate change have predicted 20-40% reduction in asset values means that beneficiaries and their families will experience severe economic hardship.

Unabated climate change cannot be diversified away. With these global changes there will be nowhere to hide; no investments will be left untouched by

climate catastrophe, fossil fuels included.

“No Place to Hide: A Climate Risk Review

by Divest Oregon is a powerful review of the system-level risks that climate change poses to the global economy, and therefore to the investment returns of long-term intergenerational pension funds.

This report makes clear that pension fund fiduciaries need to act in the near term to promote a just clean energy transition if we are going to reduce economic damage from climate change.

This release is a timely and valuable resource which provides practical recommendations and a comprehensive and actionable framework as asset owners, fellow fiduciaries of pension funds and other universal, long-term investors are seeking to align their portfolios with long-term sustainability goals while navigating an ever-evolving regulatory landscape.”

BRAD LANDER,

Comptroller, City of New York

Protecting Pension Funds

Climate Risk Management as a Core Fiduciary Responsibility

Fiduciary duties don’t change, but investment strategies must change in response to the financial risk brought on by climate change.

Fiduciaries must be impartial - protecting the pensions of young PERS members as well as current retirees.

There is Opportunity in Crisis:

The Path Forward

Public pension funds in the US control nearly $11 trillion in assets of nearly 36 million state and local beneficiaries. The crisis presents an opportunity for public pension funds to influence public policy and the market by their very investments.

Acting together, fiduciaries can move the market by investing in climate solutions, rather than climate destruction. There is already

movement in this direction, with x fund and x fund - representing $x trillion - committed to reduce their climate change risks through their investment practices.

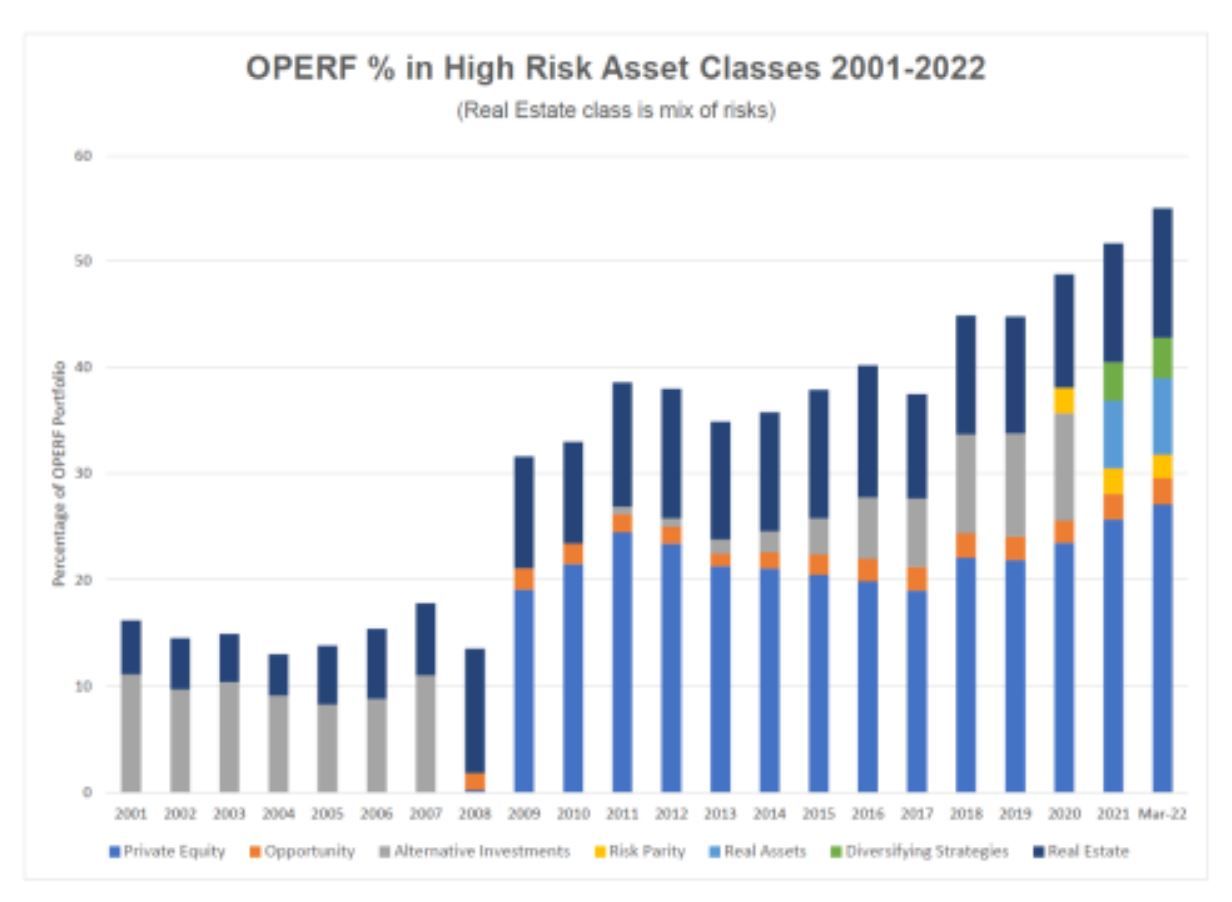

Research since the Risky Business report was published in April 2022 has revealed that over 50% of PERS is in private investments - which are highly risky. These investments are shielded from disclosure by state law and by contract. They are listed in many different asset classes in addition to the Private Equity asset class as shown in this figure - Opportunity, Alternatives, Risk Parity, Real Assets, Diversifying Strategies and Real Estate.

The amount of private investment holdings in OPERF is an extreme outlier among comparable US public pension funds. See

Oregon Treasury's Private Investment Transparency Problem

report for an in-depth analysis.

With climate change upon us and more coming, public pension fiduciaries need a comprehensive and organized examination of system-level climate risks to portfolio asset values, and how to respond to them.

This is that review.

It synthesizes more than 200 climate, economic and investment research findings and policies by academics, professionals, government, and the law.

This report details thexxxx

The report was reviewed by the following experts:

CLAIR BROWN,

Professor of Economics emerita and Director of the Center for Work, Technology and Society at the University of California, Berkeley

DAN COHN,

Energy Finance Analyst, Institute for Energy Economics and Financial Analysis (IEEFA)

AMY GRAY, Associate Director of Climate Finance, Stand.earth

JILLIAN GREGG, Founding CEO, Terrestrial Ecosystems Research Associates (TERA), Corvallis, Oregon; co-author, 2023 and 2024 State of the Climate Reports (BioScience)

BRAD LANDER,

Comptroller, City of New York

RICCARDO REBONATO, Professor of Finance, EDHEC Business School; Scientific Director, EDHEC Risk Climate Institute; author, “How to Think About Climate Change”

CHARLES SLIDDERS,

Manager & Senior Attorney, Climate Financial Strategies,

and

CONOR MACDONALD,

Staff Attorney, Climate Financial Strategies at Center for International Environmental Law (CIEL)

[?] [awaiting final approval]

CLARA VONDRICH,

Senior Policy Counsel for Climate, Public Citizen