Press Release: “First-in-the-nation” Pause Act will protect Oregon retirees from private equity’s overexposure to fossil fuels

“First-in-the-nation” Pause Act will protect Oregon retirees from private equity’s overexposure to fossil fuels

Labor unions, faith communities, and environmental groups across Oregon have endorsed Senate Bill 681, which will allow the Oregon State Treasury to “press pause” on private fossil-fuel funds.

Salem, OR -- Introduced by Chief Sponsors Senator Jeff Golden (D-Ashland) and Senator Khanh Pham (D-SE Portland),

The Pause Act (Senate Bill 681) will enact a time-bound, five-year moratorium on investment in new Oregon Public Employees Retirement System (PERS) private fossil-fuel funds. Roughly 60% of PERS investments are made in private markets, including in private equity and so-called real assets (e.g., oil and pipelines).

Private markets are overexposed to the fossil fuel sector, which carries major long-term financial risk.

“For the past 50 years, the finance sector has dangerously re-written the rules of the global economy, including in Oregon,” said Bill McKibben, Founder of Third Act. “We have seen wealth extracted from our communities while our greenhouse emissions have skyrocketed. At the leading edge of this transformation has been the aggressive expansion of the secretive and speculative private investment sector which has over a trillion dollars in fossil fuel investments and minimal transparency or oversight. The Pause Act is a ‘first-in-the-nation’ bill that will allow the Oregon State Treasury to ‘press pause’ on private investments in fossil fuels and take time to address these risks.”

“The private equity industry continues to invest workers’ retirement savings in fossil fuels with minimal transparency or oversight, despite the worsening climate crisis,” said Nichole Heil, Senior Research and Campaign Coordinator at the Private Equity Stakeholder Project. “It’s more important than ever for states to safeguard pensioners’ retirements from climate related financial risk and rein in unchecked investments in private equity oil and gas funds.”

According to the Oregon State Treasury, private equity is a

drag on PERS performance. Private investment firms charge

high fees to public pensions and are

overinvested in volatile energy markets in an effort to reap short-term profits. Moreover, companies owned by private equity firms are

more likely to oppose unionization efforts and are

ten times more likely to go bankrupt than their peers not controlled by private equity.

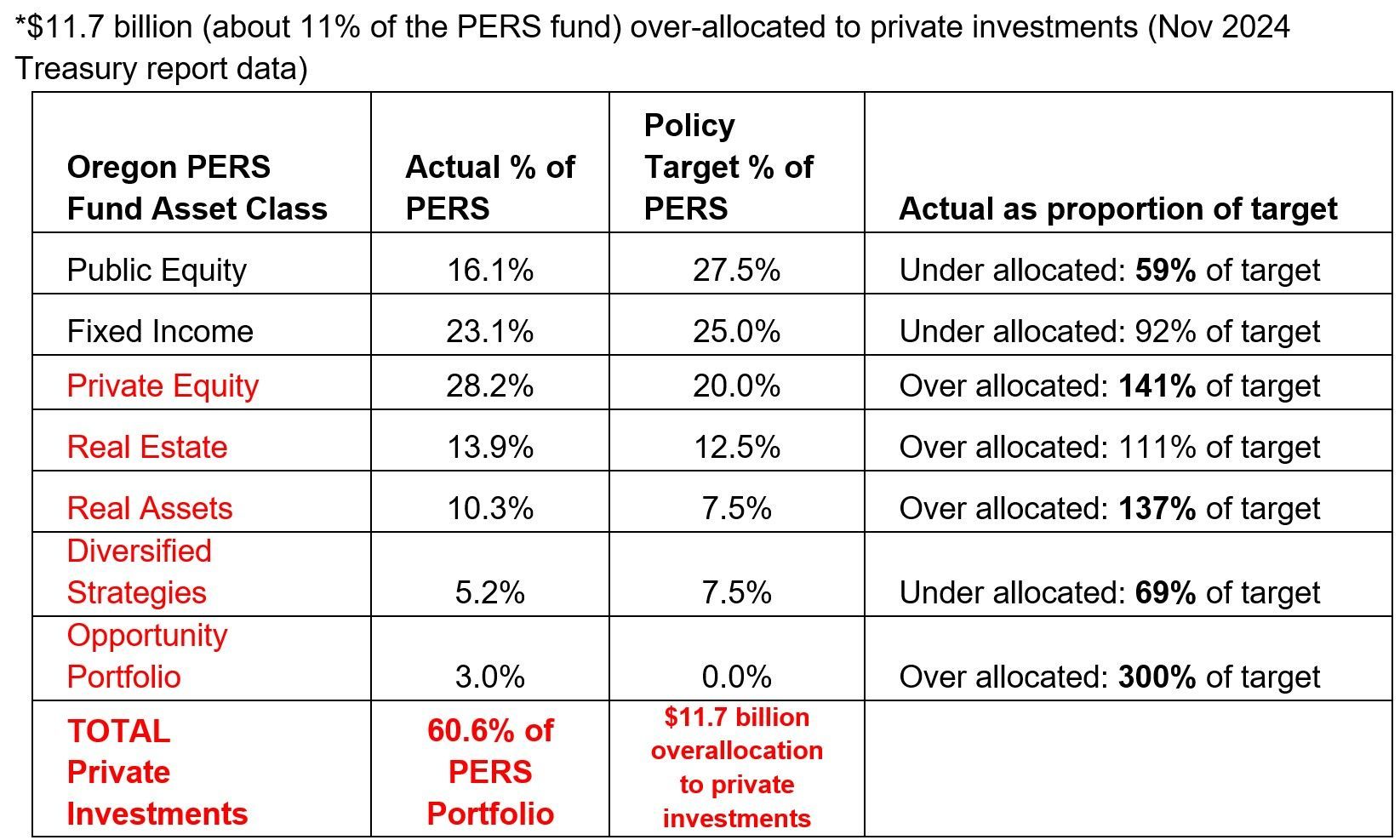

“It is clear -- by Treasury’s own admission -- that private investments are

$11.7 billion* over the limit set by the Oregon Investment Council and returns are way down. Commitment to a private fund is typically a decade-long commitment, so this portfolio imbalance is a big problem. Private investments are extractive, secretive, and risky,” said Divest Oregon co-lead Jenifer Schramm. “The Pause Act gives Treasury staff the time to address the enormous risk to the climate and to the portfolio of private investments in fossil fuels and to consider more labor-aligned, business-friendly, climate-safe investments.”

According to bill sponsors, the Pause Act aligns with former Oregon Treasurer Tobias Read’s “Pathway To Net Zero” plan, which was designed to reduce climate change risk to the PERS portfolio. This net-zero plan was

endorsed by a wide range of labor groups and political leaders in Oregon.

"The Pause Act reflects Treasury’s 'Pathway To Net Zero' plan and is designed to protect PERS from the financial risk of private investments,” said Senator Jeff Golden, the bill’s sponsor. “This is the right time to stop throwing good money after bad investments and give our dedicated Treasury staff the latitude to better align investment practices with emerging research on the risks to these funds.”

Notes: