New Report! A Comparison of US Pension Funds' Net Zero Plans

Few public pension fund trustees have adopted a plan to address the risk of climate change to their portfolio. Oregon should be applauded as one of them, yet how does Oregon’s proposed plan compare to the major net zero plans of other US public pension plans?

Divest Oregon has just released a comprehensive and detailed

Comparison of US Pension Funds' Net Zero Plans Report. It allows the Oregon Treasurer and the Oregon Investment Council (OIC) to see what other fiduciaries are planning, to adopt best practices, and to change OIC policy as needed. Climate change is moving fast, and the report should be used by Oregon PERS and all fiduciaries to move faster in implementing a strong plan.

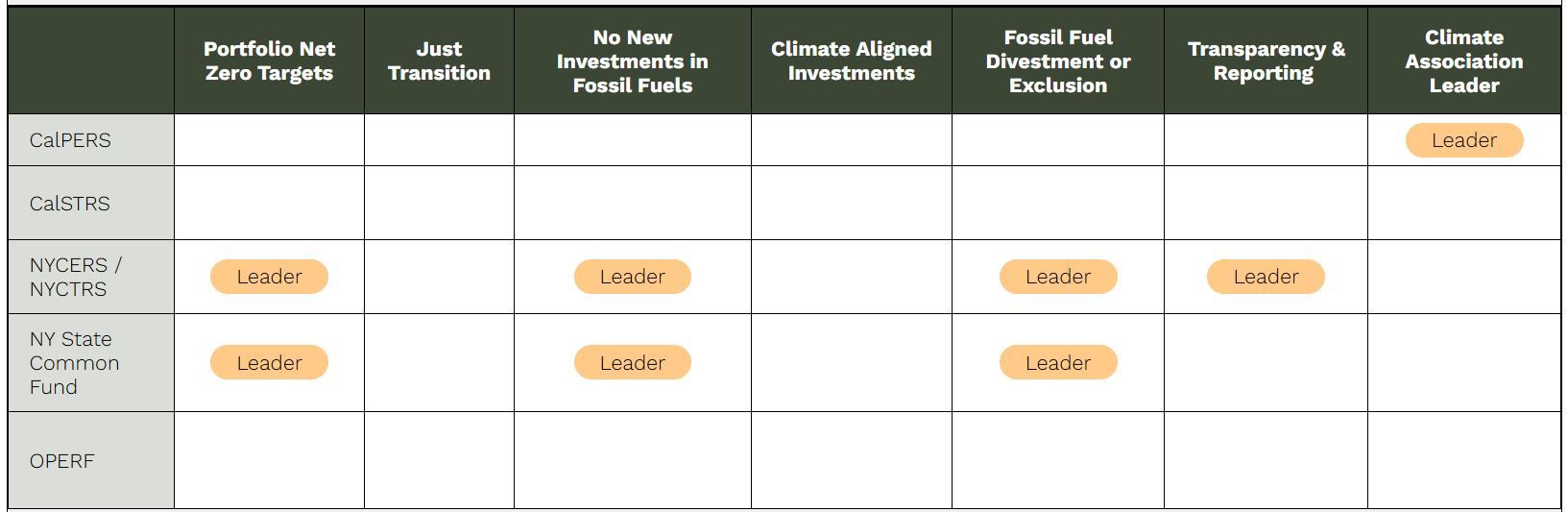

The report compares the net zero plans of public pension funds of NY City, NY State Common Fund, CalPERS, CalSTRS and Oregon PERS. These net zero plans are evaluated on 7 key criteria:

- Portfolio Net Zero Target Dates

- Just Transition

- No New Investments in Fossil Fuels

- Climate Aligned Investments

- Fossil Fuel Divestment or Exclusion

- Transparency & Reporting

- Climate Association Leader

The

Divest Oregon report includes an overview and an easy-to-read summary, so check it out!

Oregon is part of a national coalition, the Climate Safe Pensions Network, whose members will also benefit from this report.

The details of Oregon’s plan are very much a current issue. Former Oregon Treasurer Tobias Read published

A Pathway To Net Zero in 2024. The newly Treasurer, Elizabeth Steiner, is committed to having a net zero plan for the Oregon pension plan. Divest Oregon’s proposed legislation this session,

The Pause Act, focuses on the provision in the net zero plan that ends new investment in fossil fuel private funds.

The Treasury and the OIC have a duty to make productive investments that preserve and protect fund assets and the viability of the pension system. A core component of that duty is addressing the risk of climate change consequences to the financial health of the portfolio which includes 96 billion in PERS retirement funds of state employees. This task is bigger than reducing the emissions generated by the portfolio. Yet that reduction is an important aspect of weeding out or transforming investments that are undermining the entire portfolio by their contribution to climate change.