Our Demands

Burning fossil fuels is the primary cause of climate change. The Oregon Treasury continues to invest in these fossil fuels, therefore Divest Oregon demands of the Oregon Treasurer and the Oregon Investment Council:

Invest in a just, climate-safe future

End investments in fossil fuels

Address climate risk transparently

How We Make Progress

What's New

Oregon Treasury Investment Team Causes $3.7 billion loss to PERS Retirement Fund since 2023. Treasury staff disregarded policies limiting private equity investments. Overview A Divest Oregon analysis of Oregon Treasury private equity investment practices finds that years of exceeding the Oregon Investment Council’s (OIC) policy limiting high-risk private equity significantly reduced the performance of the Oregon Public Employees Retirement Fund (OPERF). These effects total about $3.7 billion in reduced value since 2023 . At the center of this issue is Oregon Treasury Chief Investment Officer Rex Kim and his investment team , whose long-term private equity acquisitions significantly exceeded OIC’s risk tolerance for OPERF as stated in its investment policy targets. The OIC is a trustee , and an agent’s failure to follow a trustee's instructions is a breach of trust . These events raise broader questions about policy oversight, internal accountability, and the Treasury’s ability to align its investment practices with new directives under the Oregon Climate Resilience Investment Act (CRIA) . Policy Departures and Oversight Challenges Since at least 2019, OPERF’s investments in private equity substantially went over the levels established in OIC’s policy targets. Corresponding reductions in lower-risk public equity went well below target. While the OIC sets investment targets, it relies on Treasury investment staff to implement them faithfully. By 2022, excessive amounts of private equity led to urgent pressure within OPERF to obtain cash for PERS benefit payments. Treasury then undertook substantial sales of public equities. During this time, the CIO argued ( audio at 1:26:40) that OIC’s private equity policy target was just “some 20 per cent artificial number” and existing overinvestments in private equities should continue. His remark highlights the continuing tension between policy set by the OIC and its implementation by Treasury leadership. Documented Financial Impact In 2025, the Oregon Journalism Project reported that Treasury’s overinvestment in private equity reduced OPERF’s exposure to better-performing public equities and caused $1.4 billion in lost value during 2024 alone. Treasury officials did not contest the reported dollar loss, although Treasurer Elizabeth Steiner noted that a single-year snapshot cannot fully capture the long-term effects of complex portfolio dynamics. Nonetheless, she acknowledged in October 2025 the need to rebalance OPERF’s exposure away from private equity toward more liquid, lower-risk assets. Broader Review by Divest Oregon Following Oregon Journalism Project reporting, Divest Oregon conducted an independent examination of Treasury’s investment return statements from January 2020 through the third quarter of 2025. Impacts were calculated by looking at investment yields as they would have been had the Treasury leadership followed OIC policy targets, and comparing them with the yields that Treasury reported. The analysis confirmed the substance of the Oregon Journalism Project’s finding of a $1.4 billion underperformance in 2024, and identified additional damage to OPERF returns totaling $2.3 billion for 2023 and 2025. Divest Oregon’s Chart 1 shows these underperformances resulted in cumulative damage of $3.7 billion to OPERF returns since 2023. Had Treasury met the OIC targets, Divest Oregon calculates that OPERF’s total returns would have increased by 1% to 1.5% annually in 2023 and 2024, improving the system’s funded ratio in 2024 by roughly 1% , from 73% to 74%.

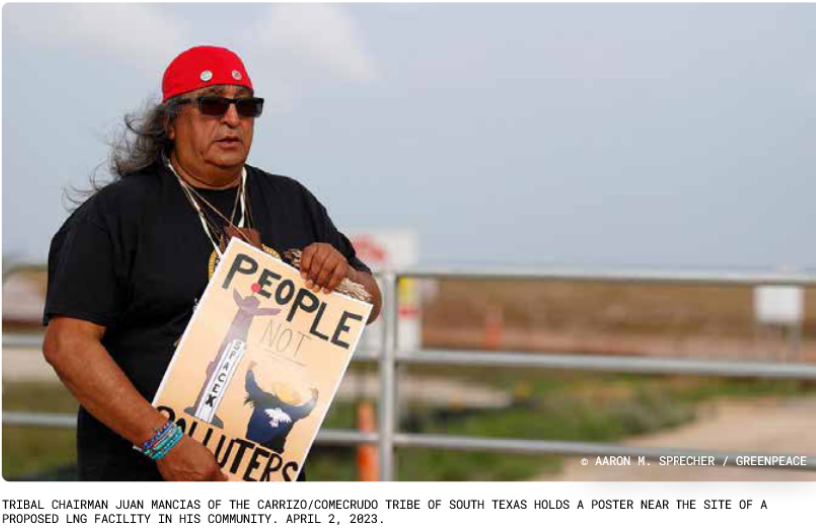

Two new reports by Divest Oregon highlight the interdependency of lowering fossil fuel investments and a just transition to clean energy. Pension funds seeking to invest in low carbon investments to support climate health must examine the impact of proposed investments on the health and well-being of communities. The Oregon Treasury is committed, by a recently passed Oregon law , to “the goal of reducing the carbon intensity of the [Oregon Public Employees Retirement] fund through a preference for investments that reduce net greenhouse gas emission” while “investing in public equity holdings that incorporate the tenets of a just transition in their overall priorities and portfolio.” Pension fund investments that do not support a just transition present a financial risk to investors. As a United Nations International Labour Organization report explains: A failure to promote a just transition represents a threat to effective climate action, and can contribute to increased inequality and fuel social unrest. This, in turn, can lead to major financial implications for banks and insurance companies as social instability, transition risks and physical climate change impacts may disrupt clients’ business operations due to interruptions in their supply chains, impacts on human health, or loss of livelihoods. In its report, Oregon Treasury’s Investment Screening Failures , Divest Oregon finds that Oregon Treasury’s failure to screen its investments results in investments that worsen the climate crisis, violate people’s rights, cause injury, and cause negative consequences to the Oregon Treasury and its holdings. The report offers examples of the interdependence of climate and investment results. One notable example is the Rio Grande Liquid Natural Gas (LNG) Export Terminal. In December of 2022, OST committed $350 million to GIP Fund V for the project. The 900-acre project was sited on sacred tribal lands without free, prior and informed consent (FPIC) in the face of strong and broad community and global opposition. Construction and operation of the terminal promised to devastate the last deepwater port in the Gulf without fossil fuel projects, and destroy key components of the local community and economy. The risks were financial as well as environmental. Multiple banks and insurers had already withdrawn their support when the Oregon Treasury chose to invest. The project had no FERC permit and was in litigation. GIP’s two previous funds had a history of underperformance. There were numerous indicators that the LNG market would be glutted by the time this project came online. A July 31, 2025 decision by FERC gave a green light to the project. As of September 2025, the earliest projected completion date is 2030. Pipeline and export terminal infrastructure is designed to last for decades with obvious repercussions for the climate and the community. Opposition to the project continues. Divest Oregon’s Just Transition and the Oregon State Treasury report describes the financial benefit to pension funds of investments that promote a just transition to clean energy. Citing the guide for investor action from the Investing in a Just Transition Initiative and United Nations’ Principles for Responsible Investment (UNPRI), it notes 5 reasons why investing in a just transition is in the best interest of beneficiaries and in line with fiduciary duties by: Responding to systemic risks Reinvigorating fiduciary duty Recognizing material value drivers Uncovering investment opportunities Contributing to societal goals The report presents recommendations for a just energy transition for public pension funds. It calls for pension funds to establish investment policies regarding Free, Prior and Informed Consent (FPIC) and Fair Labor Rights and provides a detailed explanation of these principles and their relationship to the financial health of pension funds. Citing examples of pension funds that have successfully utilized the principles of just transition like NYSERS and CalPERS, the report provides a guide for pension funds to adopt ethical and beneficial investment strategies.

Portland, OR - The Oregon Treasury’s Investment Screening Failures report revisits emblematic fossil fuel projects that the coalition identified as “investment failures” in 2023. These projects worsen the climate crisis, cause harm to communities and the environment, and result in negative economic consequences to state employees’ retirement savings that the Oregon Treasury manages. Treasury is invested in these projects either directly through a private equity fund or indirectly through stock ownership. The report argues that the Treasury must urgently adopt more rigorous screening mechanisms to better protect Oregon’s Public Employee Retirement System (PERS) and help advance a more just energy transition . “The core question of the report is: Do fund beneficiaries want their retirement money to fund the climate crisis, community destruction and human rights violations?,” said Jenifer Schramm, co-lead of Divest Oregon and the report’s author. “And, are the beneficiaries aware of the financial risk of these investments? Is the Oregon State Treasury aware of the risks?” In the fall of 2022, the Treasurer pledged a climate focus in the portfolio. A short while later, the Treasury invested hundreds of millions in a private fund dedicated to construction of a massive liquid natural gas terminal on the Texas Gulf Coast. This financially problematic investment raises the question of the Treasury’s investment selection process. The report argues that better screening, more transparency, and less reliance on notoriously secretive private investments would reduce the harm, increase trust among fund beneficiaries, and ultimately produce better returns. “The Investment Screening Failures report challenges the Oregon Treasury to tell the beneficiaries of the fund it manages how investments are chosen and what their retirement funds are supporting,” said Richard Brooks, Climate Finance Program Director of Stand.Earth. “The first Failures report graphically illustrated the fossil fuel industry’s disregard for Indigenous rights and labor rights; its destruction of climate and communities. Two years later the profiled investments look no better – and the Treasury continues to invest in the fossil fuel industry. We’ll be watching to see if the Treasury follows the report recommendations and updates its investment screening and oversight.”

Portland, OR - Following the recent passage of the Climate Resilience Investment Act ( CRIA - HB2081) requiring that Oregon follow a “just transition” for investments in public markets, a new report from Divest Oregon – Just Transition and the Oregon State Treasury – outlines the urgent need and a framework for the Treasury to support a just transition to clean energy. According to the Oregon Just Transition Alliance , a nonprofit coalition of rural, coastal, and urban communities, a just transition is “about moving from a harmful, extractive economy to one that gives more than it takes, heals more than it harms, and allows people and the land to thrive.” The new report from Divest Oregon highlights key considerations as Oregon invests in a clean-energy future, including how the Oregon State Treasury can advance labor rights and the right to free, prior, and informed consent (FPIC) for Indigenous communities. The report offers a wide range of actions that other pension funds are already implementing to safeguard the long-term sustainability of their investments while providing ways to evaluate similar efforts at the Treasury. “Advancing a just energy transition is not only a moral obligation to frontline communities impacted by Oregon’s investments, but now a legal requirement that is backed by sound financial guidance,” said Rory Cowal, lead author of the report and Divest Oregon member. “We hope that this new report will offer initial guidance for the Treasury as they create a roadmap to implement their own ‘just transition’ framework.” The report outlines the financial benefits to pension funds that promote a just transition toward clean energy, citing the guide for investor action from the Investing in a Just Transition Initiative and United Nations’ Principles for Responsible Investment (UNPRI). Pension funds that utilize these frameworks can more effectively respond to systemic risks, uncover unseen investment opportunities, and contribute to societal goals that enhance the health of the wider portfolio. While the Oregon State Treasury has emerged as an early adopter of this just transition framework, other pension funds have already successfully utilized just transition principles, including the New York State Common Retirement Fund (NYSCRF) and the California Public Employees' Retirement System (CalPERS). “Oregon Treasury’s commitment to advancing a just transition puts it in line with national and international leaders,” said Susan Palmiter, co-lead of Divest Oregon. “We hope that this report supports Treasury leadership as they take the critical steps to support a clean energy transition in a way that not only complies with the law but allows Oregonians to more fully benefit from climate-safe, rights respecting investments.”