What is the Pause Act Win?

Divest Oregon introduced The Pause Act (SB 681), with Chief Sponsor Oregon Senator Jeff Golden’s support, to enact a five-year moratorium on new or renewed Treasury investment in private fossil-fuel funds.

Why The Pause Act?

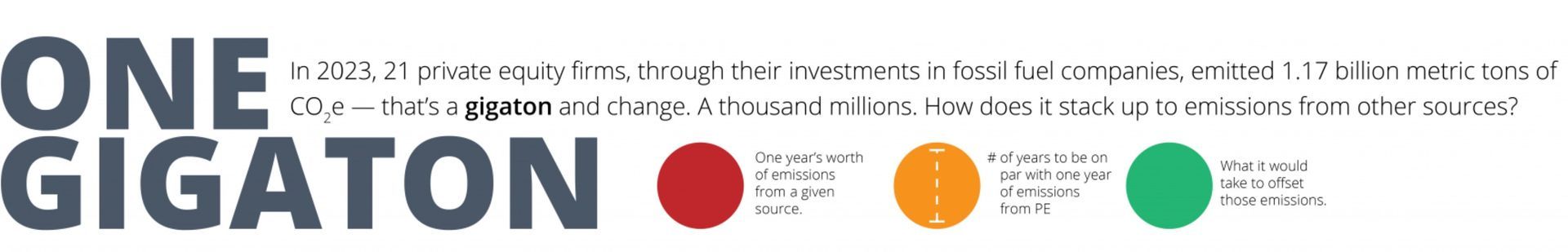

For the past 50 years, the finance sector has dangerously re-written the rules of the global economy, including here in Oregon. Wealth has been extracted from our communities while our greenhouse emissions skyrocket. At the leading edge of this transformation has been the aggressive expansion of the private investment sector, generally referred to as private equity, which has over a trillion dollars in fossil fuel investments.

The Oregon PERS portfolio is heavily weighted to private investments, which make up approximately half of the fund.

The Pause Act is based on a key provision in past Treasurer Read’s net zero plan – which recognizes that portfolio emissions cannot be meaningfully reduced without ending new investment in long-term private funds holding fossil fuels.

In the year since Treasurer Read announced his plan, to the public’s knowledge there has been no constraint on new private fund investments in fossil fuels. The Pause Act introduces transparency by requiring reporting to the public on progress under the bill.

Current Treasurer Steiner has made a commitment to emission reduction of the portfolio. The Pause Act highlights the need for urgency, reflecting the impact of the climate crisis on all Oregonians and on the PERS portfolio.

Why The Pause Act has no path forward

When Divest Oregon asked for amendment discussions on The Pause Act with Treasurer Steiner, she said she would focus only on the Treasury’s HB 2200. That bill proposes a goal of limited emission reduction and reporting, with no mention of private investments. The Chair of the Committee hearing SB 681 offered to work with all stakeholders toward a bill acceptable to all parties. Instead, the Treasury crafted two statements in opposition to The Pause Act, and so the bill died in committee despite an outpouring of public support. This support was captured in the article from Oregon Capitol Chronicle (March 20, 2025).

What did the Treasury argue in opposition to the Pause Act… and what is the Divest Oregon response?

The Treasury sent written opposition to The Pause Act to key legislators and union representatives that are on the Treasurer’s Beneficiary Advisory Committee. The pre-committee hearing Treasury statement and the Divest Oregon response was distributed to the Treasury and to the recipients of the opposition statements.

In a filed statement of opposition, the Treasury put forward arguments that are problematic. Divest Oregon has expressed these concerns to the Treasury as follows:

- While Treasury argues that SB 681 would limit diversification, SB 681 does not stop Treasury from having a diversified strategy. There is nothing in the bill that says Treasury should stop investing in private equity, real estate, or real assets – which are the major components of their private investments.

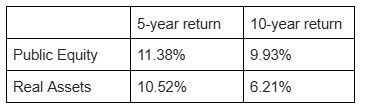

- Private investments are not always providing strong returns. Treasury’s testimony on returns compared private equity with public equity returns. That comparison was a selective misdirection. The Real Assets asset class, which are private investments, produces double the emissions intensity to the PERS portfolio than the Private Equity class, and yet those returns weren’t reported in their testimony. The Real Assets class actually has lower 5 & 10-year returns than Public Equity. (For more details, see the Divest Oregon full response to their testimony.)

Source: Jan 2025 OPERF returns from Oregon Treasury website

In ongoing conversations with Treasury, Divest Oregon will encourage them to put aside inappropriate arguments and confront the reality that the level of illiquid long-term private investment is the source of half of emissions (as noted in Treasurer Read’s plan, p 33) and stands in the way of the Treasury accomplishing the goals stated in their HB 2200. Ending new private investments in fossil fuels is a necessary step in reducing emissions.

It’s important to highlight the new Treasury administration’s current stance as Divest Oregon continues to encourage the Treasury to adopt an effective position in pursuit of our common goal: reducing risk to the PERS portfolio in the midst of climate change.

Bottom Line: The question to the Treasury going forward

What is Treasury’s plan, instead of SB 681, to “pursue the goal of reducing the carbon intensity of the fund” especially with the preponderance of private investments in the PERS portfolio?

What has Divest Oregon accomplished through legislation?

Getting legislation passed is only one way the Divest Oregon coalition has been able to accomplish Divest Oregon goals. Here’s a little history:

- 2022 Legislation: Treasury Transparency bill to get information about the public equity and fixed income holdings —> passed the House floor, ran out of time

- Late 2022: Treasury released Public Equity and Fixed Income holdings information.

- 2023 Legislation: Treasury Investment & Climate Protection Act to divest from fossil fuels —> did not pass out of committee

- Nov 2023: Treasurer announced Pathway to Net-Zero Plan

- Feb 2024: Treasurer released Pathway to Net-Zero Plan.

- 2024 Legislation: The COAL Act to divest public funds from coal —> passed!

- 2024 December Report: Treasury described how it is analyzing coal investments with a road towards divestment.

- 2025 Legislation: The Pause Act to pause new fossil fuel investments in private market funds —> committee hearing

What has The Pause Act accomplished?

Divest Oregon is engaged in ongoing discussions with the Treasury on a number of topics, including their stated goal of portfolio emission reduction and addressing climate risk to the portfolio. Divest Oregon’s years of pressure were a factor in Treasurer Read creating a Net Zero Plan and in the past and current Treasurers seeking to mandate the creation of an emissions-reduction plan through legislation. The Pause Act built on and continues that advocacy.

SB 681, the Pause Act, created pressure on the Treasury, from the legislature and Divest Oregon members, to get specific as to

how it will reduce emissions and confront the risk of climate to the portfolio. The Pause Act messaging makes it clear: The Treasury must take an essential step to stop digging the hole deeper and address the elephant in the portfolio: long term private investment in fossil fuels.