How is the OST investing the money you earned for retirement?

Here’s one example:

A 2023 investment brought the total amount the Oregon Treasury (OST) has committed to private equity firm NGP Energy Capital’s oil and gas Funds to $1.2 BILLION since 2012.

NGP is a Carlyle Group subsidiary.

NGP continues to expand its upstream investments (exploration and production companies) with a current portfolio of around 20 oil and gas companies with operations in multiple states – like Tap Rock Resources in New Mexico, whose impacts fall disproportionately on communities of color.

Carlyle Group holds a majority stake in Private Equity company NGP. A

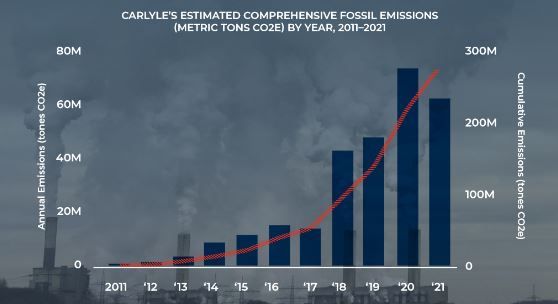

new investigation released by Private Equity Stakeholder Project – which provides the content of this update – reveals that the Carlyle Group (Carlyle), a private equity titan with $373 billion in assets under management, has been quietly scooping up fossil fuel assets over the past decade, in contravention of its

stated climate goals. Its billions of dollars of investment in fossil fuel assets produced an estimated 277 million metric tons of CO2 emissions over just ten years, as much as the “carbon bomb” that Alaska’s Willow arctic drilling project

is set to emit in its entire lifetime.

Carlyle’s estimated $22.4 billion fossil fuel portfolio also exposes its own investors to a range of climate-related risks, and its lack of comprehensive disclosures prevents the public, regulators, and investors from being able to adequately assess and mitigate those risks.

“The capital Carlyle has used to bloat their massive fossil fuel portfolio has come off the backs of public employee pension funds, university endowments, and other institutional investors,” said Amanda Mendoza, climate researcher at Private Equity Stakeholder Project.

Carlyle stands out among large diversified private equity firms as having one of the largest energy portfolios, mostly devoted to fossil fuels. Its portfolio has approximately $22.4 billion in carbon-based energy companies and only an estimated $1.4 billion committed to renewable and sustainable energy companies—less than 1 percent of total assets under management.

“It was eye-opening to uncover the sheer amount of gas-fired power plant capacity that Carlyle owns through their portfolio companies. It ranks as one of the largest owners of gas plants in the United States, yet the average rate payer likely has no idea who Carlyle is or how to hold it accountable,” said Alex Hurley, research analyst at Global Energy Monitor. “It was also shocking to review the number of pollution-related violations recorded by the EPA for the Carlyle power plant fleet, many of which are located steps away from low-income communities and communities of color who bear that impact.”

Regrettably, Carlyle is far from the only private equity firm with ongoing investments in oil and gas. Since 2010, at least $1.1 trillion has been channeled into oil and gas exploration, extraction, pipelines, and power plants worldwide. Private equity firms often adopt strategies like saddling portfolio companies with debt and implementing aggressive cost-cutting measures, which force these companies to take excessive risks in pursuit of rapid profit growth. These companies then struggle to operate when resources that should have been allocated to capital improvements, maintenance, environmental safeguards, asset retirement and remediation, or decarbonization are instead redirected to Wall Street investors.

Was Carlyle and its subsidiary a good choice even on a management level? A May 2023 update stated, "Carlyle Group fundraising drops by half as head of private equity, other executives depart."

Although this is a private equity firm/fund (see its website), OST posted this investment in its “Alternatives” Asset Class: see NGP Energy Capital Natural Resources and Royalty Partners funds. While the Private Equity Asset Class holds about a quarter of OPERF investments, OST has private investments in most of its asset classes and the private investment total is over half of OPERF. We’ll continue to provide information on other private equity investments OST chose to make, as we manage to obtain information on these black-box funds.