NEW REPORT: In 2023, 21 Private Equity Fund Holdings Emitted a Gigaton of Carbon Oregon owns 11 of them!

The newly released 2024 Private Equity Climate Risks Scorecard & Report by our allies, Private Equity Stakeholder Project, Global Energy Monitor, and Americans for Financial Reform Education Fund, gives us new insight into private equity firms and OST investments in these secret funds.

Twenty-one major private equity firms manage $6

trillion in assets – and two-thirds of the energy companies in their portfolios are invested in fossil fuels.

Oregon state employees’ pension plan (PERS) invests in 11 of these 21 funds.

From Private Equity Climate Risks: https://www.peclimaterisks.org/2024scorecard/

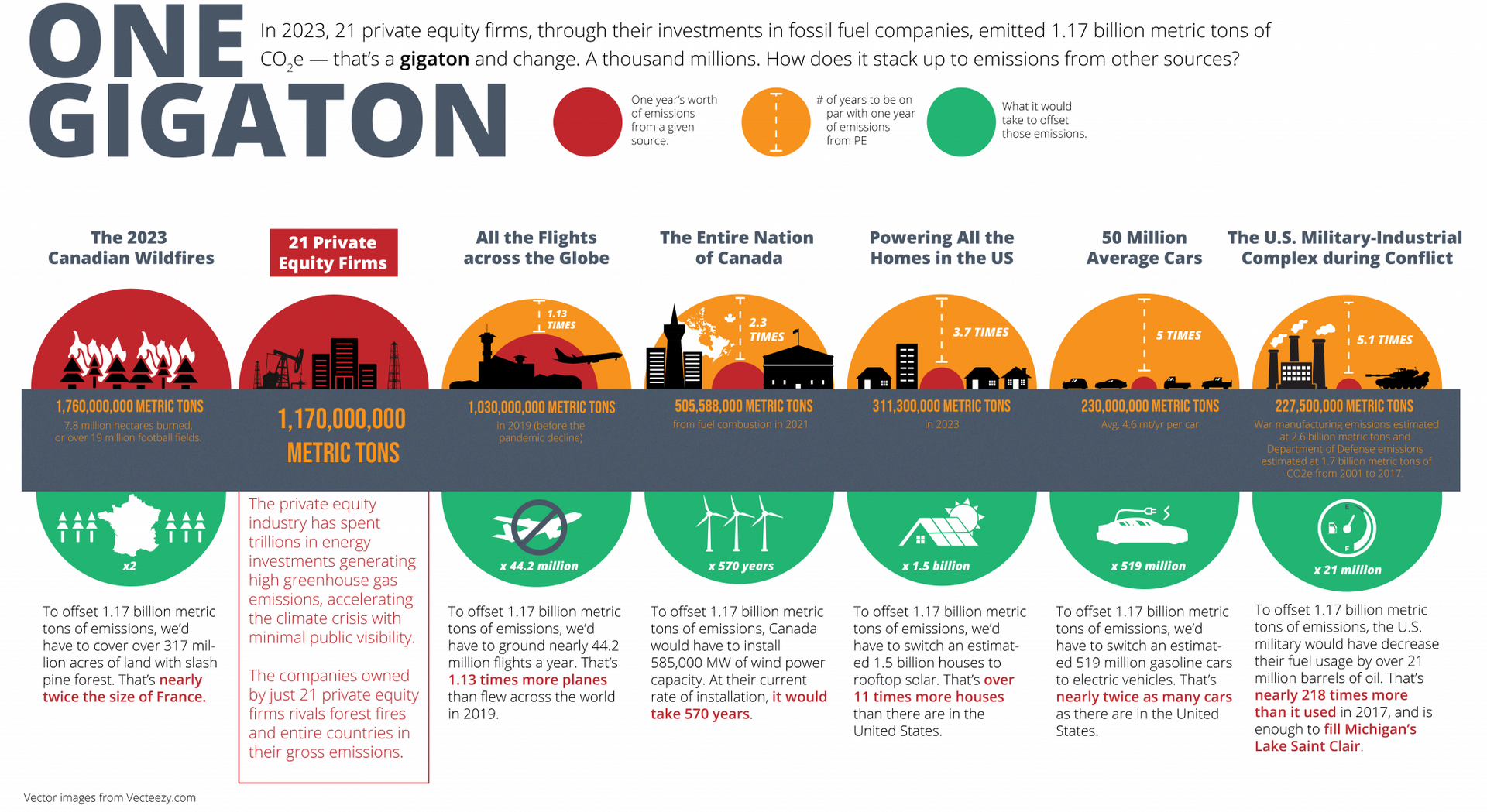

The 21 funds are responsible for 1.17 billion metric tons CO2 equivalent of emission each year from upstream oil and gas, liquefied natural gas (LNG) terminals, and coal-fired power plants.

That gigaton level of emissions is more than three times the energy used to power all the homes in America. It exceeds the global aviation industry and is on the scale of the 2023 Canadian wildfires. See the graphic above.

With over a trillion dollars in energy investments that generate high greenhouse gas emissions, noted in the new report, private equity firms have an outsized role in accelerating the climate crisis – and these investments expose their investors, including the Oregon State Treasury, and all the beneficiaries who rely on the Treasury, to significant financial risk.

Investment by the Oregon State Treasury (OST) in fossil fuels has persisted in the face of a clear link between their investments and risk. An October 2021 report,

Private Equity Propels the Climate Crisis, documented OST investment in 6 out of 10 of the largest private equity firms with approximately 80% of their energy investments in oil, gas, and coal.

It is difficult for the public and often even for investors to access data on private fund investments – which commit funds for a decade. Information about private fund commitments is shielded from disclosure by state statute and contract. Our allies have undertaken laborious independent research to offer a window into an opaque and largely unregulated industry – and its enormous fossil fuel footprint.

The

2024 Scorecard’s researchers and 22 endorsing organizations, including Divest Oregon, demand that the private equity firms adopt five important climate standards. These standards urge that institutional investors like OIC add their voices in support of the firms to:

1. Align with science-based climate targets to limit global warming to 1.5⁰c

2. Disclose fossil fuel exposure, emissions and impacts

3. Report a portfolio-wide energy transition plan

4. Integrate climate and environmental justice and

5. Provide transparency on political spending and climate lobbying