Oregon's Public University Fund: Divested from Fossil Fuels with same or better returns

In the past, the Oregon Treasury invested the Public University Fund (PUF) in the Oregon Short Term Fund, the Oregon Intermediate Term Fund, and the Public University Long Term fund. In January 2017, when the PUF Board of Trustees passed the resolution amending their investment policy to divest from fossil fuels it was decided that the Treasury would stop using the Oregon Intermediate Term Fund for PUF because that fund’s policies do not restrict investment, such as using the Carbon Underground 200 (CU 200).

The Treasury established a separate fund for PUF to manage the fossil fuel-free mandate, called the PUF Long Term Fund. The PUF would still invest in the Oregon Short Term Fund (OSTF) as the Treasury stated that the OSTF had no fossil fuel investments in it. Divest Oregon has found that the Short Term Fund does have fossil fuels in it as of 2022.

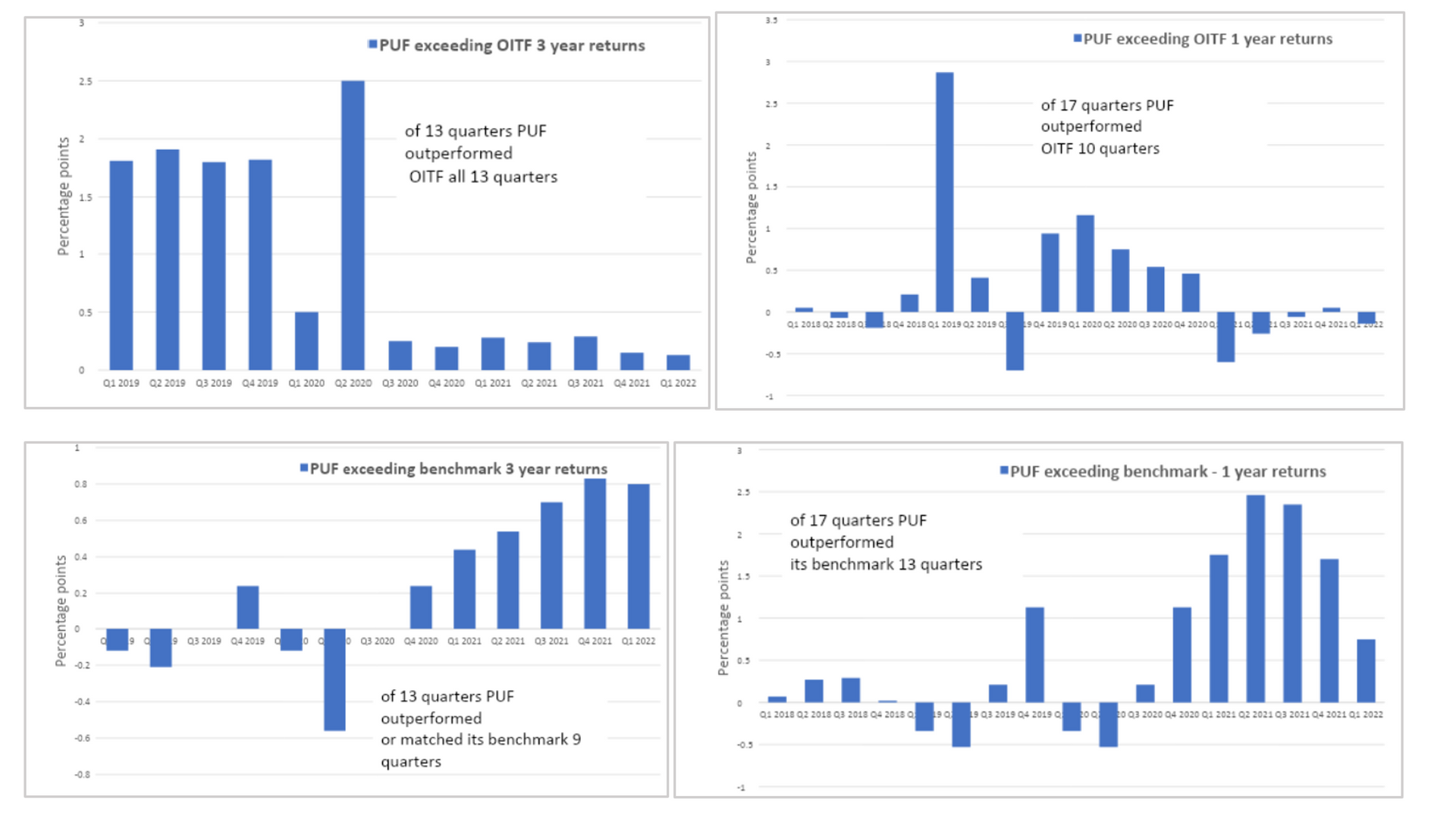

This analysis looks at the PUF Long Term Fund after fossil fuel divestment as compared to:

1) its benchmark, established by the Treasury staff as a performance metric, and

2) its performance to the Oregon Intermediate Term Fund (OITF) – the fund they left.

The analysis looks at the funds’ returns for 1 year and 3 years. Consistent data was available for the PUF, its benchmark and the OITF from Q1 2018 through Q1 2022 for 1 year returns, therefore there are results for 17 quarters for 1 year returns. Consistent data was available for the PUF, its benchmark and OITF from Q1 2019 through Q1 2022 for 3 year returns, therefore there are results for 13 quarters for 3 year returns.

The figures below provide these data.

In summary, the PUF without fossil fuel investments matched or exceeded its benchmark and the OITF the majority of the time.