Press Release: New Divest Oregon Campaign Pushes State Treasury to Lead on Climate

April 10, 2022

Following a summer of record-shattering heat and extreme fires across Oregon, a statewide coalition is urging the Oregon Treasury to divest from risky fossil fuels and support a financially-sound, clean energy future.

Press Contact: Andrew Bogrand, Communications Director (abogrand@divestoregon.org)

A growing coalition of thirty-five organizations

in Oregon representing workers, environmentalists, public sector employees, and people of faith launched the Divest Oregon: Reinvest in a Fossil-Free Future

campaign urging the Oregon Treasury to end all new investments in the fossil fuel industry, disclose current fossil fuel holdings, and phase out all current investments by 2026.

“This summer, local governments received a stark reminder–if it was needed–of the deadly impact of the climate crisis,” said Multnomah County Commissioner Susheela Jayapal.

“Divesting from fossil fuels sets Oregon on the path to envision new investments that promote our economy, environment, and public health; and follows in the footsteps of Oregon counties and municipalities that have already divested including Multnomah County and the City of Portland. We must divest Oregon from fossil fuels now. Our state, economy, and livelihoods depend on it.”

New research

suggests that institutional investors like the Oregon Treasury could force meaningful cuts in emissions by reallocating capital away from companies that drill for oil and gas and mine coal. The Oregon Treasury remains invested in fossil fuels despite multiple risks that could hurt returns for public sector employees, imperiling their retirements. Most of the Treasury’s holdings are in the $90 billion Oregon Public Employee Retirement Fund (PERS), which the Treasury manages.

Almost one in ten Oregonians are exposed to fossil fuel risks through pensions managed by the Oregon Treasury. BlackRock–the world’s largest asset manager–has highlighted these risks and the fundamental reallocation of capital

that is rapidly transforming energy investments: fossil-free funds are outperforming conventional ones.

“Of course I am worried about the climate crisis, but I am also worried about my PERS retirement outlook,” said Patty Hine, a retired community college professor and commander in the US Navy from Eugene.

“I don’t need to work on Wall Street to know that the fossil-fuel sector has a limited lifespan. When it comes to my money, I want Oregon to make prudent, long-term financial decisions that support the environment and all children’s futures. Divesting from risky fossil fuels and reinvesting in promising, clean energy opportunities would be a great start.”

Always volatile, coal and oil markets have become riskier as environmental regulations tighten worldwide, including in China, the U.S., and the European Union. More than 80 percent

of all new electricity capacity added last year was renewable, according to the International Renewable Energy Agency, demonstrating the world’s preference for clean fuels over dirty ones. Exxon shares have dropped by more than 25% in three years, and the company was removed from the Standard & Poor’s 500 Index.

“The physical impacts of climate change on the value of investments together with the changes implied by the energy transition that is already underway present a major risk for beneficiaries of public pensions, including in Oregon,” said Christopher Abbruzzese, Chief Investment Officer for Rain Capital Management in Portland.

“Pensions control more than $35 trillion in assets globally and some of the largest have already begun divesting from fossil fuels, so it’s not hard to see how this process could have systemic implications. Add to that the fact that traditional approaches to valuation and risk management are largely based on historical data, making them really bad at dealing with seismic shifts like this. You have to ask yourself if the State of Oregon has the visibility to be prudently invested in fossil fuels right now. Look at it this way: in 1847, with the advent of petroleum, the fiduciary would have had an obligation to reconsider the wisdom of investing in whalers and harpoons. If this is our 1847 moment with decarbonization, Oregon needs to get ahead of it.”

Dozens of large institutions are already going fossil free, including the University of California, with a $126 billion portfolio, and the State of New York, with a $226 billion portfolio. Last week, Harvard University

also said it has divested almost all of its $42 billion endowment from fossil fuels. In the last decade, the fossil fuel divestment movement has grown to encompass more than 1,100 government, corporate, educational, non-profit, and faith institutions

with $11 trillion in assets under management.

“There is a climate imperative for Oregon to divest from fossil fuels, and anyone who’s smelled the smoke in the air these last summers knows about that. But there is also a compelling financial reason for Oregonians to support this campaign, too,” said 350.org

co-founder Bill McKibben. “Simply put: fossil fuels are a bad investment. The energy transition is here. Major and mainstream asset managers recognize this and are looking to reinvest in sustainable energy solutions that better reflect the needs of our local economies and communities on the frontlines of this climate crisis. Oregonians need a pension to retire on, but they need a working planet to retire on too!”

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts

Thanks to the passage of CRIA and the Coal Act, Oregon is moving toward a more transparent assessment of climate-related risks, engaging with asset managers and companies, and identifying climate-positive investments. OPERF has nearly $90 million invested with Exxon, $40 million in Chevron, and $5 million in Shell. Can the Treasury hold these companies accountable and protect the wider portfolio from major conflict exposure? Following is incisive testimony to the January 2026 Oregon Investment Council by Andrew Bogrand, Divest Oregon’s volunteer Communications Director. For over five years, the Divest Oregon coalition has encouraged the Oregon State Treasury to take seriously the financial risks associated with fossil fuel investments, particularly within the context of the wider energy transition. Treasury, as well as the Oregon Investment Council, has listened and responded. Thanks to the 2025 Climate Resilient Investment Act (CRIA) and the 2024 Clean Oregon Asset Legislation (COAL) Act , our state is moving toward a more transparent assessment of climate-related risks, engaging with asset managers and companies, and identifying climate-positive investments. Of course, much of the work remains. In the spring of 2025, Divest Oregon provided testimony to lawmakers in Salem about the coalition’s support of CRIA. We shared how the bill would help Treasury address “new economic realities, where geopolitical contestation…and natural resource competition will upend the financial logic of passive investing.” A year later, this statement rings painfully true. We stand on the precipice of resource-driven conflicts in Venezuela, Greenland, and Iran. We are witnessing a deterioration of the international rules-based order, which will come with serious financial implications. This breakdown is not random. Chevron has played “the long game” in Venezuela, spending millions lobbying the Trump administration and positioning itself to profit following the US invasion. Shell is seeking a multi-billion gas project following the illegal ouster of President Maduro, which presumably also secured ExxonMobil’s interests – not in Venezuela, but in neighboring Guyana . And, the American Petroleum Institute, an industry lobby group including Chevron, Shell, and Exxon, recently pledged to “stabilize Iran” if the regime is ousted there, too. Of course, whether these companies will profit from this new era of resource colonialism remains unclear. Darren Woods, the CEO of ExxonMobil, said bluntly that Venezuela is “un-investable.” Chevron has also acknowledged that any future work in Venezuela will require extensive guarantees and long-term stability, conditions which remain absent. Despite all the money spent on lobbying, the oil market remains volatile and these companies will likely seek taxpayer support and sanctions relief for risky bets abroad Treasury has nearly $90 million invested with Exxon, nearly $40 million in Chevron, and over $5 million in Shell. Now the question is how to hold these companies accountable and protect the wider portfolio from major conflict exposure. Not all energy companies are equal. In contrast to Chevron, France’s TotalEnergies, which Treasury also owns, has no intention to enter Venezuela despite its operations in nearby Suriname, presumably worried that their presence could make a humanitarian crisis worse or even directly fund human rights violations. If Treasury is serious about engagement, as set forth in CRIA, now is the time to exercise this commitment toward the most politically-exposed companies. Extraction by military force pushes the absolute boundaries of the social license to operate and undermines other holdings in Treasury’s portfolio. Companies have a major and well-recognized responsibility to avoid contributing to war. This responsibility is rooted in the UN Guiding Principles on Business and Human Rights as well as in international humanitarian law. Companies are expected to conduct rigorous human rights due diligence to ensure that their operations, supply chains, and technology do not fuel or contribute to conflict. If companies like Chevron and Exxon fail to respond to engagement along these lines then divestment is both an appropriate business decision -- and the right thing to do.

Oregon Treasury Investment Team Causes $3.7 billion loss to PERS Retirement Fund since 2023. Treasury staff disregarded policies limiting private equity investments. Overview A Divest Oregon analysis of Oregon Treasury private equity investment practices finds that years of exceeding the Oregon Investment Council’s (OIC) policy limiting high-risk private equity significantly reduced the performance of the Oregon Public Employees Retirement Fund (OPERF). These effects total about $3.7 billion in reduced value since 2023 . At the center of this issue is Oregon Treasury Chief Investment Officer Rex Kim and his investment team , whose long-term private equity acquisitions significantly exceeded OIC’s risk tolerance for OPERF as stated in its investment policy targets. The OIC is a trustee , and an agent’s failure to follow a trustee's instructions is a breach of trust . These events raise broader questions about policy oversight, internal accountability, and the Treasury’s ability to align its investment practices with new directives under the Oregon Climate Resilience Investment Act (CRIA) . Policy Departures and Oversight Challenges Since at least 2019, OPERF’s investments in private equity substantially went over the levels established in OIC’s policy targets. Corresponding reductions in lower-risk public equity went well below target. While the OIC sets investment targets, it relies on Treasury investment staff to implement them faithfully. By 2022, excessive amounts of private equity led to urgent pressure within OPERF to obtain cash for PERS benefit payments. Treasury then undertook substantial sales of public equities. During this time, the CIO argued ( audio at 1:26:40) that OIC’s private equity policy target was just “some 20 per cent artificial number” and existing overinvestments in private equities should continue. His remark highlights the continuing tension between policy set by the OIC and its implementation by Treasury leadership. Documented Financial Impact In 2025, the Oregon Journalism Project reported that Treasury’s overinvestment in private equity reduced OPERF’s exposure to better-performing public equities and caused $1.4 billion in lost value during 2024 alone. Treasury officials did not contest the reported dollar loss, although Treasurer Elizabeth Steiner noted that a single-year snapshot cannot fully capture the long-term effects of complex portfolio dynamics. Nonetheless, she acknowledged in October 2025 the need to rebalance OPERF’s exposure away from private equity toward more liquid, lower-risk assets. Broader Review by Divest Oregon Following Oregon Journalism Project reporting, Divest Oregon conducted an independent examination of Treasury’s investment return statements from January 2020 through the third quarter of 2025. Impacts were calculated by looking at investment yields as they would have been had the Treasury leadership followed OIC policy targets, and comparing them with the yields that Treasury reported. The analysis confirmed the substance of the Oregon Journalism Project’s finding of a $1.4 billion underperformance in 2024, and identified additional damage to OPERF returns totaling $2.3 billion for 2023 and 2025. Divest Oregon’s Chart 1 shows these underperformances resulted in cumulative damage of $3.7 billion to OPERF returns since 2023. Had Treasury met the OIC targets, Divest Oregon calculates that OPERF’s total returns would have increased by 1% to 1.5% annually in 2023 and 2024, improving the system’s funded ratio in 2024 by roughly 1% , from 73% to 74%.

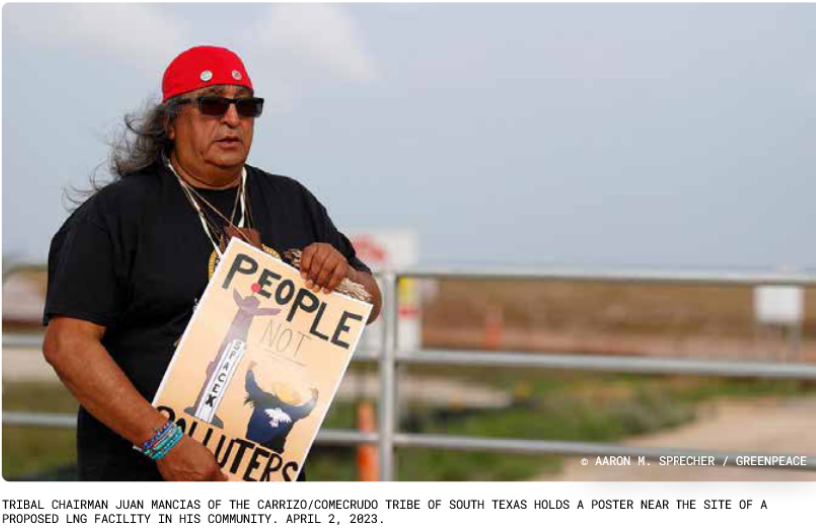

Two new reports by Divest Oregon highlight the interdependency of lowering fossil fuel investments and a just transition to clean energy. Pension funds seeking to invest in low carbon investments to support climate health must examine the impact of proposed investments on the health and well-being of communities. The Oregon Treasury is committed, by a recently passed Oregon law , to “the goal of reducing the carbon intensity of the [Oregon Public Employees Retirement] fund through a preference for investments that reduce net greenhouse gas emission” while “investing in public equity holdings that incorporate the tenets of a just transition in their overall priorities and portfolio.” Pension fund investments that do not support a just transition present a financial risk to investors. As a United Nations International Labour Organization report explains: A failure to promote a just transition represents a threat to effective climate action, and can contribute to increased inequality and fuel social unrest. This, in turn, can lead to major financial implications for banks and insurance companies as social instability, transition risks and physical climate change impacts may disrupt clients’ business operations due to interruptions in their supply chains, impacts on human health, or loss of livelihoods. In its report, Oregon Treasury’s Investment Screening Failures , Divest Oregon finds that Oregon Treasury’s failure to screen its investments results in investments that worsen the climate crisis, violate people’s rights, cause injury, and cause negative consequences to the Oregon Treasury and its holdings. The report offers examples of the interdependence of climate and investment results. One notable example is the Rio Grande Liquid Natural Gas (LNG) Export Terminal. In December of 2022, OST committed $350 million to GIP Fund V for the project. The 900-acre project was sited on sacred tribal lands without free, prior and informed consent (FPIC) in the face of strong and broad community and global opposition. Construction and operation of the terminal promised to devastate the last deepwater port in the Gulf without fossil fuel projects, and destroy key components of the local community and economy. The risks were financial as well as environmental. Multiple banks and insurers had already withdrawn their support when the Oregon Treasury chose to invest. The project had no FERC permit and was in litigation. GIP’s two previous funds had a history of underperformance. There were numerous indicators that the LNG market would be glutted by the time this project came online. A July 31, 2025 decision by FERC gave a green light to the project. As of September 2025, the earliest projected completion date is 2030. Pipeline and export terminal infrastructure is designed to last for decades with obvious repercussions for the climate and the community. Opposition to the project continues. Divest Oregon’s Just Transition and the Oregon State Treasury report describes the financial benefit to pension funds of investments that promote a just transition to clean energy. Citing the guide for investor action from the Investing in a Just Transition Initiative and United Nations’ Principles for Responsible Investment (UNPRI), it notes 5 reasons why investing in a just transition is in the best interest of beneficiaries and in line with fiduciary duties by: Responding to systemic risks Reinvigorating fiduciary duty Recognizing material value drivers Uncovering investment opportunities Contributing to societal goals The report presents recommendations for a just energy transition for public pension funds. It calls for pension funds to establish investment policies regarding Free, Prior and Informed Consent (FPIC) and Fair Labor Rights and provides a detailed explanation of these principles and their relationship to the financial health of pension funds. Citing examples of pension funds that have successfully utilized the principles of just transition like NYSERS and CalPERS, the report provides a guide for pension funds to adopt ethical and beneficial investment strategies.

Portland, OR - The Oregon Treasury’s Investment Screening Failures report revisits emblematic fossil fuel projects that the coalition identified as “investment failures” in 2023. These projects worsen the climate crisis, cause harm to communities and the environment, and result in negative economic consequences to state employees’ retirement savings that the Oregon Treasury manages. Treasury is invested in these projects either directly through a private equity fund or indirectly through stock ownership. The report argues that the Treasury must urgently adopt more rigorous screening mechanisms to better protect Oregon’s Public Employee Retirement System (PERS) and help advance a more just energy transition . “The core question of the report is: Do fund beneficiaries want their retirement money to fund the climate crisis, community destruction and human rights violations?,” said Jenifer Schramm, co-lead of Divest Oregon and the report’s author. “And, are the beneficiaries aware of the financial risk of these investments? Is the Oregon State Treasury aware of the risks?” In the fall of 2022, the Treasurer pledged a climate focus in the portfolio. A short while later, the Treasury invested hundreds of millions in a private fund dedicated to construction of a massive liquid natural gas terminal on the Texas Gulf Coast. This financially problematic investment raises the question of the Treasury’s investment selection process. The report argues that better screening, more transparency, and less reliance on notoriously secretive private investments would reduce the harm, increase trust among fund beneficiaries, and ultimately produce better returns. “The Investment Screening Failures report challenges the Oregon Treasury to tell the beneficiaries of the fund it manages how investments are chosen and what their retirement funds are supporting,” said Richard Brooks, Climate Finance Program Director of Stand.Earth. “The first Failures report graphically illustrated the fossil fuel industry’s disregard for Indigenous rights and labor rights; its destruction of climate and communities. Two years later the profiled investments look no better – and the Treasury continues to invest in the fossil fuel industry. We’ll be watching to see if the Treasury follows the report recommendations and updates its investment screening and oversight.”

Portland, OR - Following the recent passage of the Climate Resilience Investment Act ( CRIA - HB2081) requiring that Oregon follow a “just transition” for investments in public markets, a new report from Divest Oregon – Just Transition and the Oregon State Treasury – outlines the urgent need and a framework for the Treasury to support a just transition to clean energy. According to the Oregon Just Transition Alliance , a nonprofit coalition of rural, coastal, and urban communities, a just transition is “about moving from a harmful, extractive economy to one that gives more than it takes, heals more than it harms, and allows people and the land to thrive.” The new report from Divest Oregon highlights key considerations as Oregon invests in a clean-energy future, including how the Oregon State Treasury can advance labor rights and the right to free, prior, and informed consent (FPIC) for Indigenous communities. The report offers a wide range of actions that other pension funds are already implementing to safeguard the long-term sustainability of their investments while providing ways to evaluate similar efforts at the Treasury. “Advancing a just energy transition is not only a moral obligation to frontline communities impacted by Oregon’s investments, but now a legal requirement that is backed by sound financial guidance,” said Rory Cowal, lead author of the report and Divest Oregon member. “We hope that this new report will offer initial guidance for the Treasury as they create a roadmap to implement their own ‘just transition’ framework.” The report outlines the financial benefits to pension funds that promote a just transition toward clean energy, citing the guide for investor action from the Investing in a Just Transition Initiative and United Nations’ Principles for Responsible Investment (UNPRI). Pension funds that utilize these frameworks can more effectively respond to systemic risks, uncover unseen investment opportunities, and contribute to societal goals that enhance the health of the wider portfolio. While the Oregon State Treasury has emerged as an early adopter of this just transition framework, other pension funds have already successfully utilized just transition principles, including the New York State Common Retirement Fund (NYSCRF) and the California Public Employees' Retirement System (CalPERS). “Oregon Treasury’s commitment to advancing a just transition puts it in line with national and international leaders,” said Susan Palmiter, co-lead of Divest Oregon. “We hope that this report supports Treasury leadership as they take the critical steps to support a clean energy transition in a way that not only complies with the law but allows Oregonians to more fully benefit from climate-safe, rights respecting investments.”

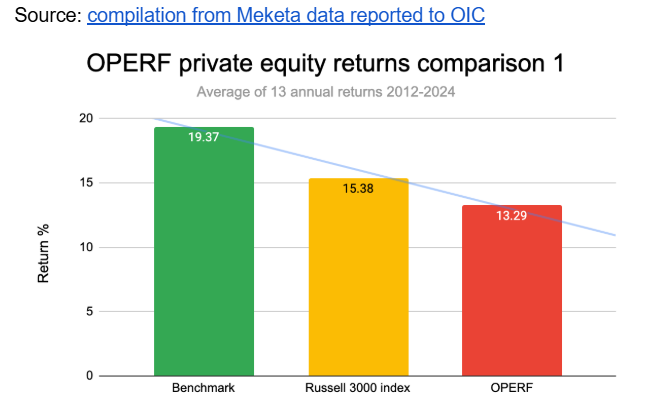

To respond to a news release by the Treasury that their most recent quarterly returns have been excellent, Divest Oregon publishes this set of charts that focus on the following statements and question: Private equity hasn’t delivered superior performance over the long term to OPERF Treasury staff disregarded OIC private equity policy and invested too heavily for many years OPERF allocations to all forms of high-risk opaque private investments are out of step with peers Can an unreformed Treasury culture be relied on to implement Net Zero policy? A statutorily required OIC complete investment program audit is five years overdue Divest Oregon looks forward to a public statement from the Treasury that addresses these issues and questions.

At the September 3rd Oregon Investment Council (OIC) meeting, Divest Oregon members made strong statements about the need to curb private investments. Risky, illiquid, high-fees and low-returns investments obscure a lot of the emissions that PERS is funding - and are difficult to divest in times when the need to be nimble is more critical than ever. You can read some of the testimony about not following allocation policy financial and climate risk promises by the Treasurer stewardship concerns AFT-Oregon’s Harper Haverkamp spoke of concerns of 17,000 members that are reflected in the recent AFT/AAUP National report . This report calls out pension funds’ private investments as antithetical to AFT’s values. Nichole Heil, from Private Equity Stakeholder Project , traveled from California to speak about the climate devastation and financial risk of two private investments made by the Oregon Treasury. More media coverage is showing up around the state about private investments at the Oregon Treasury. See the September 2 article from Willamette Week and the Oregon Journalism Project entitled, “More Questions Arise About State Investments in Private Equity.”

Treasury’s Love Affair with Private Investments Doesn’t Add Up Two recent, major investigations by The Oregonian and the Oregon Journalism Project in Willamette Week and statewide local newspapers, recently detailed significant problems with the Oregon State Treasury’s private equity overexposure for PERS. Following these publications, Divest Oregon has received questions about the information and risks of this exposure, which our coalition has tracked with concern for years. In this memo, we provide answers. By standard financial yardsticks, Treasury’s private equity investments in the past 13 years routinely underperformed the benchmark long established by the Oregon Investment Council (OIC). They regularly underperformed the broad US stock market. They have not provided exceptional returns. Simply put, Treasury’s love affair with private equity no longer adds up. OPERF’s 10-year rolling average private equity returns are substantially below OIC’s benchmark OIC Investment Policy 1203 (at p.11) says that OPERF's private equity allocation is managed to produce net excess returns “over very long time horizons, typically rolling, consecutive 10-year periods” (emphasis added). Below are the 1, 3, 5 and 10-year third-quarter private equity rolling returns Treasury presented to the OIC at its 1-22-2025 meeting , at p.59. All OPERF 1, 3, 5 and 10-year rolling returns are below OIC’s benchmark (Russell 3000 stock index + 3%) by substantial amounts, though Treasury's website at p.9 says 1-year stated returns are not meaningful.