The Urgency of Now to Shift to Renewables

These articles were shared with the members of the Oregon Investment Council in June 2024.

When considering the speed of the transition, here are some important data points:

- Electric Cars are Suddenly Becoming Affordable (NYTimes Business Section, 6/3/2024)

“The E.V. market has hit an inflection point,” said Randy Parker, chief executive of Hyundai Motor America, which will begin producing electric vehicles at a factory in Georgia by the end of the year. “The early adopters have come. They’ve got their cars. Now you’re starting to see us transition to a mass market.”

- IEA expects global clean energy investment to hit $2 trillion in 2024 (Reuters, 6/5/2024)

- The Cleantech Revolution (Rocky Mountain Institute, 6/2024)

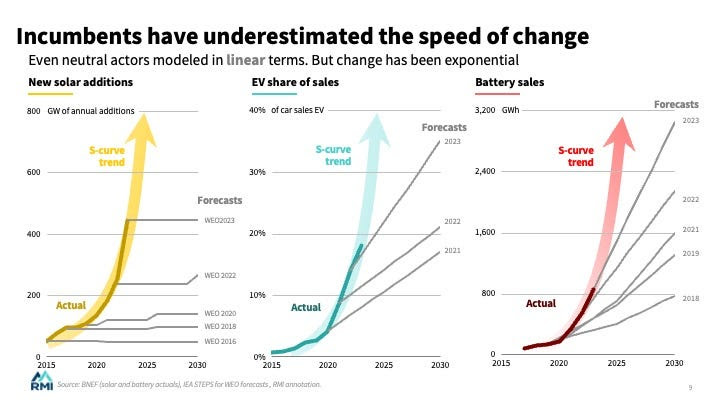

The world has moved on to the steep part of the S curve (as shown below), which will sweep us from minimal reliance on renewable energy to minimal dependence on fossil fuel. Last year or this year, we will hit peak fossil fuel demand — the advent of cheap solar and wind and batteries, combined with rapidly developing technologies like heat pumps and EVs, has finally caught up with the surging human demand for energy even as more Asian economies enter periods of rapid growth. (comments by Bill McKibben)

When considering the risk of not taking firm action regarding climate risk to the portfolio, this recent Forbes article may be of interest:

- The Shares Heard Round The World: How Citizen Stockholders Fight With Finance (Forbes, 6/10/2024)

Note that the risk calculated by Ortec recently for the Government of Singapore (GIC) is even higher than the risk calculated back by Ortec in 2021/2022 for OPERF.

The author states: “There is another type of risk that cannot be prudently minimized through diversification, however, called “systemic” or “systematic” risk. Systemic risk causes assets to decline in value together; diversification is of no help. The investing world was jarred into recognition of systemic risk by the Global Financial Crisis of 2007-2009, when broad markets declined in sync (the peak-to-trough decline in the S&P 500, for example, was 57%). That particular systemic risk was unforeseen by most investors, but presently there are a number of systemic risks that we can identify and even expect, that will have severe implications for retirement accounts and funds. One of these is climate change..

These data have obvious implications for pension fund trustees’ fiduciary duty to protect trust property. Fiduciaries can protect their funds from transition risks by changing their investment mix to reflect changing energy practices and policies. But they cannot protect the trust from systemic climate-caused physical damage by diversification. Their only option is to take all reasonable actions to do what they can, jointly with other institutional investors, to engage and support company practices and governmental policies that will abate climate change.