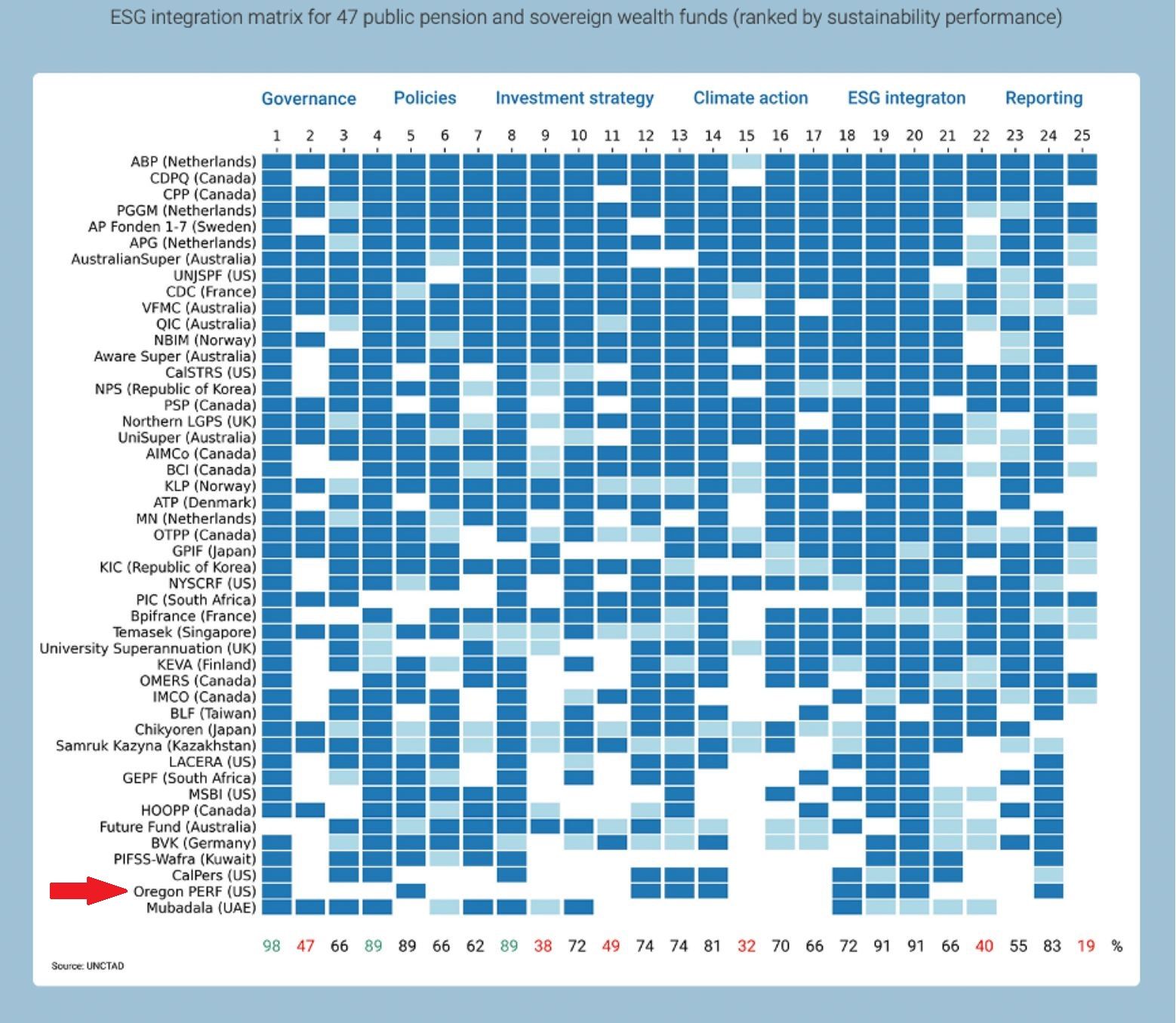

Oregon Treasury gets an F in United Nations’ ESG report card

PERS scores 46th out of 47 major funds, just above UAE fund

In his inaugural address as Treasurer in 2016, Tobias Read committed to “always invest for the long term” to “address challenges that, if ignored, will impact all Oregonians,” specifically citing “an environment and economy threatened by climate change” as one of those “challenges.”

He followed up in 2017 by having the Legislature approve Oregon’s first investment officer focused on the Environmental, Social and Governance (ESG) factors “in pursuit of improved sustainability metrics, more transparent financial reporting, and ways to integrate what we learn into how we make decisions.” In September 2018, he further convened an Oregon Sustainable Investing Summit, with keynotes from national financial leaders, highlights of OST renewable investments, and a discussion of “how Treasury evaluates climate risk,” among other topics, which was published in a 2017 “Corporate Governance and ESG Stewardship” report.

What has the Oregon Treasury accomplished in the 5 years since this early ESG commitment?

The United Nations recently published a 2021 ESG report card on the world’s top asset funds. Oregon’s Public Employee Retirement Fund (OPERF) was included along with 47 of the world’s top 100 funds that report on their ESG efforts. Unlike many states with multiple separate state pension funds for state employees (firefighters, teachers, government workers, etc.) Oregon has a single large fund – 12th largest in the country – giving it significant market presence. PERF was rated at the bottom in its ESG performance, 46th out of the 47, just above a sovereign fund in the United Arab Emirates (UAE).

Oregon’s PERF was credited for achieving 9 out of the 25 performance areas. These included:

- having a clearly stated ESG mission and vision

- adopting international standards or benchmarks and joining an international climate response initiative

- committing to integrating ESG issues in investment decisions

- actively engaging with companies through stockholder voting

What was found lacking was the operationalization of OST’s stated commitments. The UN reviewers found:

- no use of any ESG screens for actual investment decisions

- no evidence of any team dedicated to coordinate ESG investments

- no stated targets / goals for ESG investing

- no specific sector strategies (eg renewable energy)

- no climate risk metric monitoring or reporting of the use of specific climate targets / goals

- no evaluation or auditing of its ESG performance with specific metrics

Indeed, this picture is very consistent with the Treasury’s response to Divest Oregon's demand for climate action. The Treasury commissioned and then buried their own two climate risk reports showing significant losses to Treasury from holding vs divesting from fossil fuel investments; they opposed 2022 legislation to bring greater transparency to Treasury’s fossil fuel holdings; they opposed 2023 legislation calling on them to make no new fossil fuel investments and fully report those they have; and, just recently, they have committed another half billion dollars to private, illiquid funds with fossil fuel exposure.

Treasurer Read has now committed to presenting a “decarbonization plan” to the Oregon Investment Council by February 2024. As he approaches the end of his final term as Treasurer, Read has the opportunity to deliver on the promise he made at his inauguration in 2017: to “address challenges that, if ignored, will impact all Oregonians” – through measurable action and not just words, hopefully soon. As the latest 2023 IPCC report reminds us, time is fast running out.

For a full report about the Oregon State Treasury’s failings to implement ESG, see the upcoming Divest Oregon report to be released April 19, 2023.