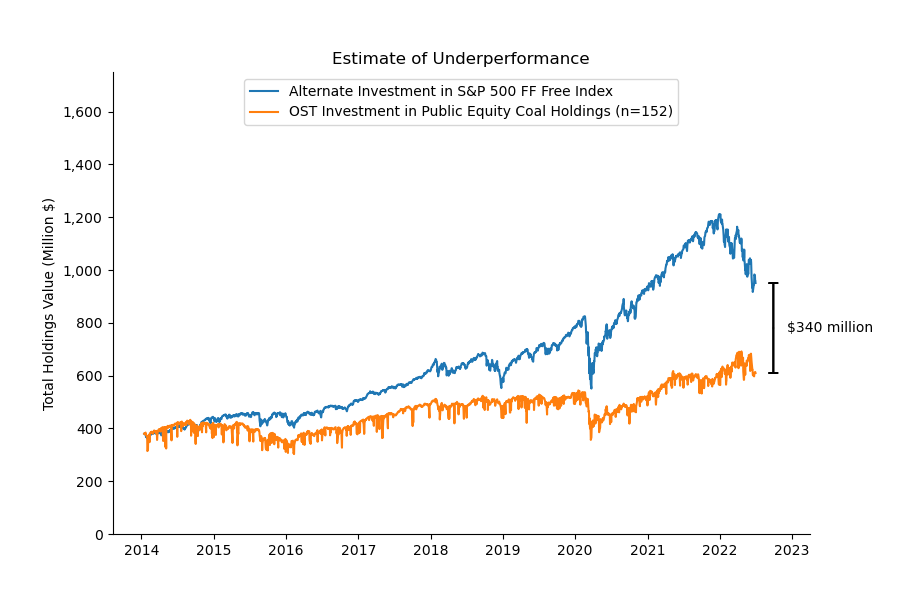

OST Public Equity Coal Holdings Underperformed by an Estimated $340 Million

Coal is a dying industry, it has declined in value over time, and its use is harmful to the health of all life forms. An increasing number of financial institutions, and public pension funds such as NYCERS, CalPERS and CalSTRS, are exiting coal to avoid holding stranded assets. Yet, as of June 30, 2022, the Oregon State Treasury (OST) had over $1 billion invested in thermal coal-related stocks, bonds and private investment funds, and these investments support the retirement of over 380,000 members of the Public Employees Retirement System (PERS).

Divest Oregon set out to analyze how those coal stocks have performed over the last nine years to determine if they have underperformed or performed well when compared to investing in the Standard and Poor’s (S&P) fossil fuel free index.

PERS’ public equity holdings as of June 30, 2022 were reviewed using the

Global Coal Exit List from Urgewald (GCEL). GCEL is a list of companies that covers the entire thermal coal value chain from coal exploration and mining to coal power production and coal gasification. It was created by Urgewald to give financial institutions a tool to understand the coal holdings in their portfolios. For 2021, the most recent GCEL available when the analysis was done, any company that generated 20% or more of its revenue or power generation from coal was on the list. It is updated annually and is the most comprehensive public database on the global coal industry. The review generated a set of 152 specific coal holdings with a market value of $610 million as of June 2022.

If the PERS holdings in those coal companies had alternatively been invested in the S&P fossil fuel free index fund starting in January 15, 2014, they would have outperformed the coal investments by an estimated $340 million.

Time series supporting estimate of coal underperformance. Lower line (orange): total value of the 152 public equity coal holdings with available data modeled backward in time from the June 2022 value. Upper line (blue): modeled reinvestment of the January 2014 estimated value in the S&P 500 Fossil Fuel Free Index.

The underperformance in the PERS portfolio due to coal investments is most likely much higher than this conservative estimate. OST has more holdings in coal, such as investments in corporate bonds and private investments, thus this result is only a partial analysis of the actual exposure to coal held by OST. The specific investments in private equity funds are unavailable via public records request because of state laws prohibiting their release. Thus, the performance of their coal components cannot be evaluated by the public. An October 2021 report by Private Equity Stakeholder Project (PESP) found that approximately 80% of energy investments made by the top 10 private equity firms since 2010 are in oil, gas and coal. OST’s September 2023 private equity portfolio invests in seven of these top ten firms (Oaktree Capital, KKR, Blackstone, Warburg Pincus, Apollo, TPG, CVC).

For more details on methodology used for this analysis, read this report, “Oregon State Treasury Coal Investment Performance Analysis.”

Oregon State Treasury should engage or divest from companies fueling a new era of resource conflicts