What We Know…and What We Don’t…about Emissions from OST Investments

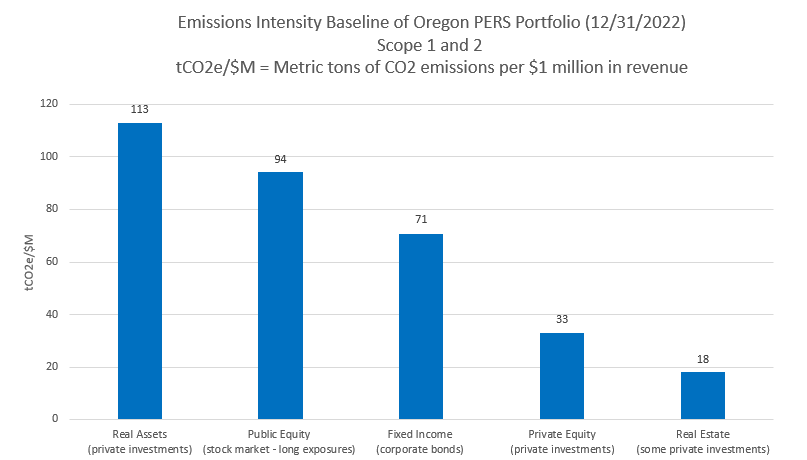

At a roundtable with Divest Oregon organizations and Treasurer Read in August 2023, Divest Oregon was provided the following PERS emissions data (additional follow up details were provided by the Treasury). This chart shows Emissions Intensity by PERS asset class. Notably missing are other private investment asset classes of Opportunity, Alternatives, and Diversifying Strategies.

Figure 1. Emissions Intensity baseline of Oregon PERS Portfolio by asset class

Almost half of the emissions are from private investment asset classes Real Assets and Private Equity, along with some probably in Real Estate. The Fixed Income asset class contains bonds that support private fossil fuel investments.

Note: These data may be revised by the Treasury. They shared that, "some of these findings are continuing to be refined as we continue to learn more from our investment managers."

Private investments are the biggest challenge in a decarbonization or divestment plan, since investment in private funds is typically made under a 10 to 12 year contract. Private investments are a major issue in the decarbonization plan Treasurer Read is now crafting, since over half of the PERS portfolio is invested in private funds. The specific investments of a private fund are exempted from public disclosure by state statute. As we have documented in earlier updates, we know through statements made to the OIC and research by the Private Equity Stakeholder Project that hundreds of millions of dollars have continued to be invested by OST in fossil fuels, through private funds, in 2023 alone.

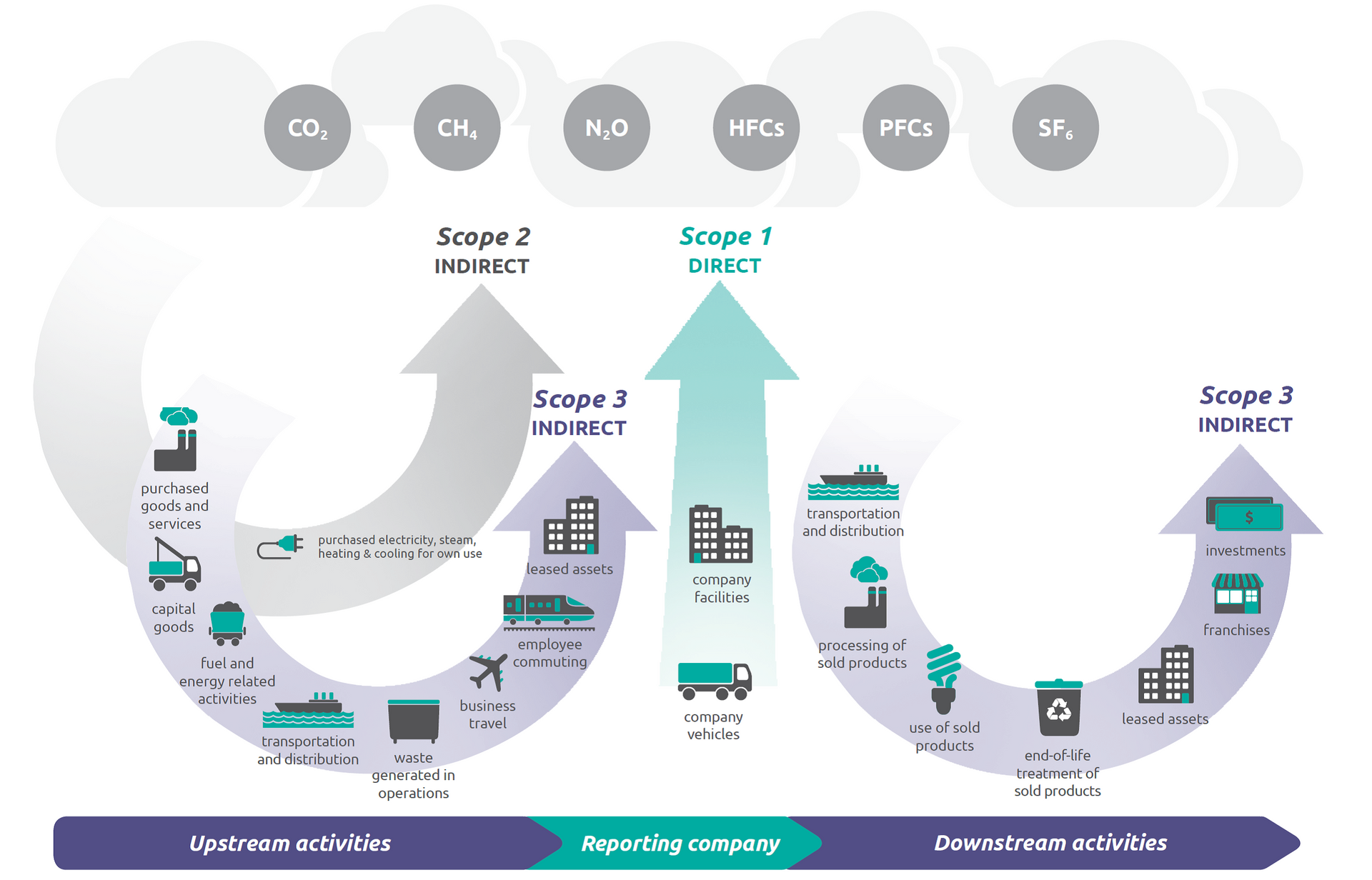

Note that the information Treasury is reporting is just Scope 1 and Scope 2 emissions, and not the more extensive and harder to measure Scope 3. Here is a chart from the

EPA website describing what is included in each category:

Figure 2. Overview of Greenhouse Gas Protocol scopes and emissions across the value chain