2023 investments data reveals “business as usual” at Oregon State Treasury

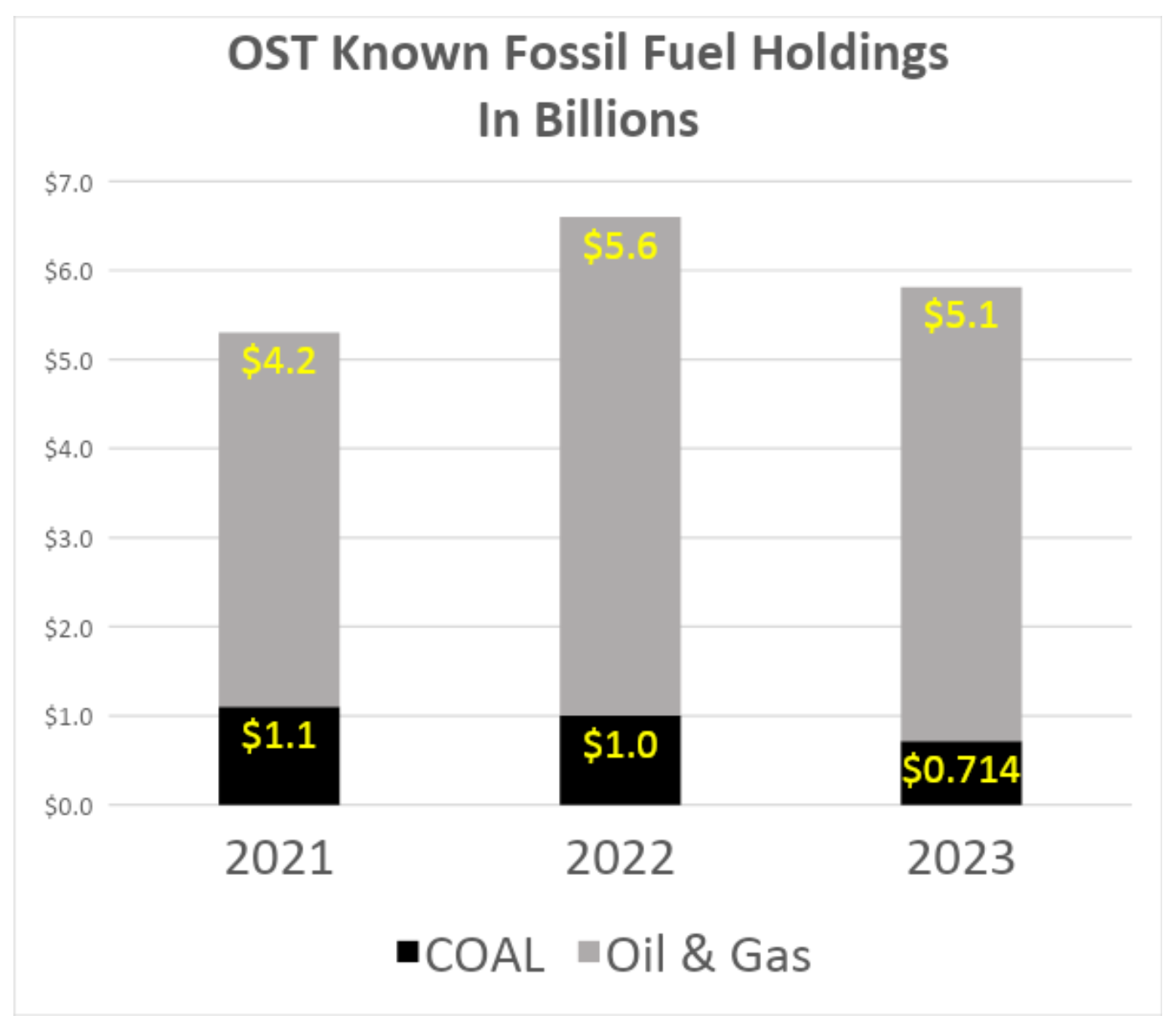

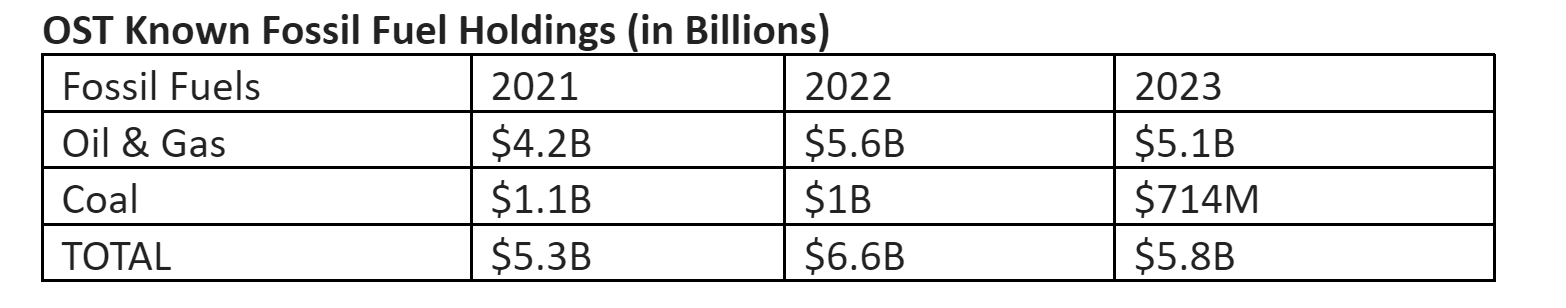

The latest Oregon State Treasury (OST) data for June 30, 2023 reveals that when it comes to its fossil fuel holdings in its portfolio, the Treasury is still following a “business as usual” approach. The consequence of this risky business strategy is falling value in its fossil fuel investments. As discussed in the Divest Oregon report, Oregon State Treasury Coal Investment Performance Report, coal prices are dropping and production costs are increasing. This value drop is across all its fossil fuel holding types, as detailed in the January 2024 report by IEEFA, noting a negative outlook for the oil and gas industry.

As a result of Divest Oregon making repeated public records requests for data of the Oregon Treasury’s portfolio holdings, starting with the 2021 data, each December the Treasury now publishes information about some of the investments on their web site. Divest Oregon published its

methodology last year. Continuing their year on year comparison showed that COAL/GCEL holding value reduced ∼ 30%.

Chart 1: Amount of known investments in fossil fuels present in the OST investments for OPERF and the Short Term Fund. OST continues to have significant holdings in oil, gas and coal.

The reduction in the value of coal holdings shown in the 2023 results are most likely indicative of the way the market is moving, and not because anyone in Treasury is deliberately reducing their coal holdings. As an investment, coal is a loser, and its decline in value makes it all the more important for the OST to get out of coal soon, rather than waiting and selling their coal holdings at a big loss. Examples include OST’s holding in CLP, a listing on the GCEL list. As of June 30, 2023 OST had 1.2 million shares valued at $9 million but the share price has dropped 34% over the past 5 years. Similar examples include Anglo American PLC and DTE energy. The Divest Oregon COAL Act aims to legislate the divestment of all OST thermal coal holdings in order to protect returns for PERS members and to protect the environment.

One egregious example of OST’s investment in coal is its 2015 investment of $500m in the Gavin Coal Plant. When OST committed PERS funds to Blackstone Capital Partners VII, it committed to fund a power plant in Cheshire, Ohio that is the seventh largest source of carbon dioxide emissions in the United States. Cheshire is now a ghost town because of the plant, and Gavin has been

ordered by the EPA to stop dumping coal ash into the Ohio River.

The bottom line is, whether we are talking about $6.6B or $5.8B in investments in fossil fuel, this is a significant amount of money that would have real impact if the Oregon State Treasury invested it in the green economy.

Thank you to Stand.earth for sponsoring this analysis, conducted by Third Rail Economy.